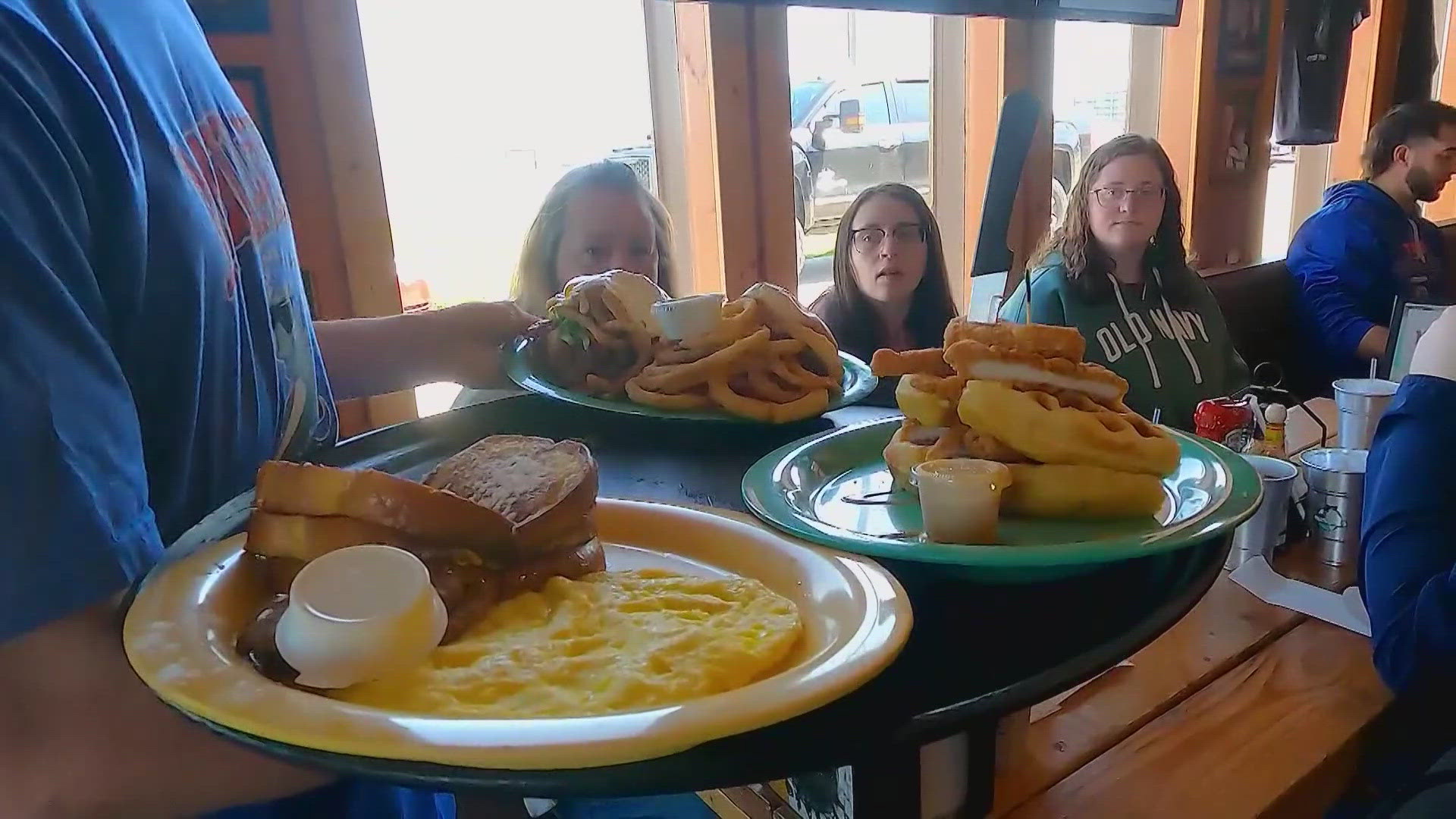

SPRINGFIELD, Va. — Whether it’s sushi to-go from your favorite grocery store or a breakfast sandwich at a café, Fairfax County officials are exploring how taxing these types of items could bring more revenue.

At a meeting on Tuesday, the Fairfax County Board of Supervisors approved a plan to consider the trade-offs of having a meals tax of up to 6%. They’ve instructed the county executive to study the potential idea and return with feedback in September.

Items would typically include prepared meals at grocery stores, restaurants, and convenience stores.

Supervisor Dalia Palchik proposed the plan alongside Chairman Jeff McKay and Vice Chair Kathy Smith. McKay and other supporters say at a time when schools have been severely underfunded by the commonwealth, a meals tax would help increase money.

Mateo Dunne, the Mount Vernon school board member, rallied for a meals tax in 2016, but voters shot it down. There was another referendum in 1992 but it also failed.

“Our teachers are underpaid at every stage of their career, and we need additional revenue because the state is underfunding Fairfax County Public Schools by more than half a billion dollars,” Dunne said.

McKay said this would help ease the burden of relying on real estate taxes, which the county recently raised by three cents, bringing the average property tax bill to more than $450.

“I don't want to keep going into the pocket of real estate to pay for those bills if we could find other sources of revenue to offset that,” McKay told WUSA9. “It’s just unfair to homeowners of Fairfax County for us not to look at this.”

Most of the jurisdictions in the region have already implemented a meals tax.

“We got a ton of people coming to Fairfax County everyday eating at our restaurants and not paying anything to help support our local community,” he said. “At least we consider getting revenue from people outside the county.”

Supervisor Pat Herrity was the only member to vote against the plan. He stressed how residents shouldn’t have to deal with another tax.

“Our residents have soundly rejected the meals tax in prior referendums, the Board should be listening to its residents,” Herrity said.

While the process for now entails research and seeking extensive input, customers in Springfield are already skeptical.

“The county already has enough taxes as it is and it doesn't bring back anything,” Arin Moore, a mother in Springfield, told WUSA9.

“I'm not sure taxing food would be the right avenue to be honest with you because food is how you live,” Fairfax County resident Jason Hawkins said. “I think people are already strapped for food right now.”