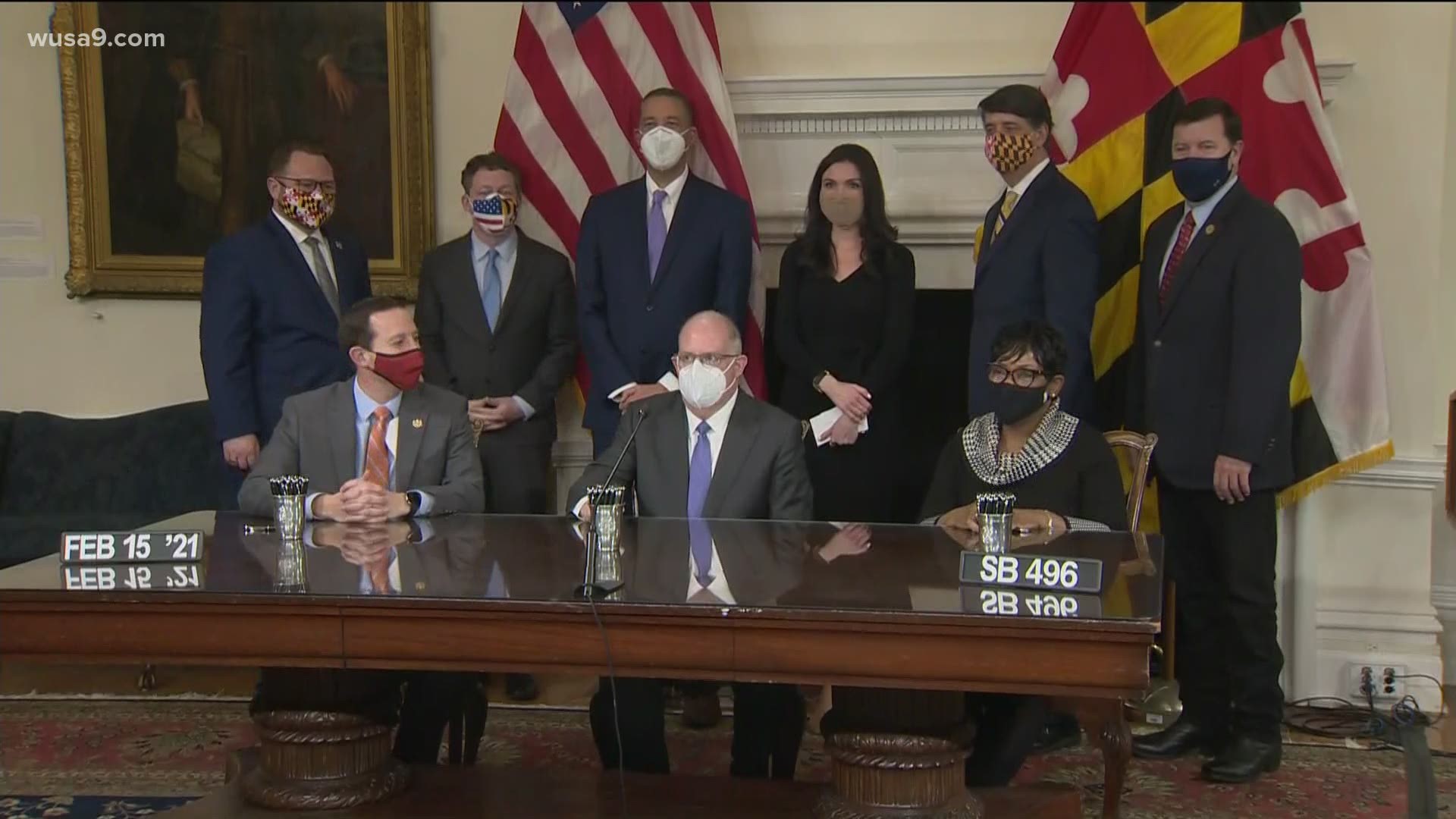

ANNAPOLIS, Md. — Maryland Gov. Larry Hogan signed the bipartisan RELIEF Act of 2021 Monday to provide a $1 billion package of emergency coronavirus relief to families and small businesses.

The legislation repeals all state and local taxes on unemployment benefits and includes immediate stimulus payments of $500 for families and $300 for individuals who filed for the Earned Income Tax Credit.

Marylanders qualify for these payments if they annually earn:

● $50,954 ($56,844 married filing jointly) with three or more qualifying children ● $47,440 ($53,330 married filing jointly) with two qualifying children

● $41,756 ($47,646 married filing jointly) with one qualifying child

● $15,820 ($21,710 married filing jointly) with no qualifying children

In total, the payments provide $178 million in relief to 400,000 Marylanders.

The RELIEF Act also targets more than 55,000 Maryland small businesses by providing sales tax credits of up to $3,000 per month for three months (total of $9,000).

"The RELIEF Act offers a real lifeline to those hardest hit people who are struggling to get by and small businesses desperately trying to stay afloat," Hogan said. "They can keep their doors open and keep more people on the payroll."

Hogan said the bill will also protect businesses against any tax increase triggered by the receipt of state loan or grant funds.

Maryland has already provided more than $700 million in state relief to businesses and individuals during the pandemic, including $220 million in grants and forgivable loans to small businesses and $80 million specifically for bars and restaurants.

"As Washington remains divided and gridlocked, Maryland has once again shown the nation that both parties can still come together, that we can put the people’s priorities first, and that we can deliver real, bipartisan, common sense solutions to the serious problems that face us," Hogan said.