ANNAPOLIS, Md. — Maryland Gov. Larry Hogan announced a $1 billion package of emergency coronavirus relief legislation on Monday that would repeal taxes on unemployment benefits and send $750 in additional stimulus funds directly to Maryland families.

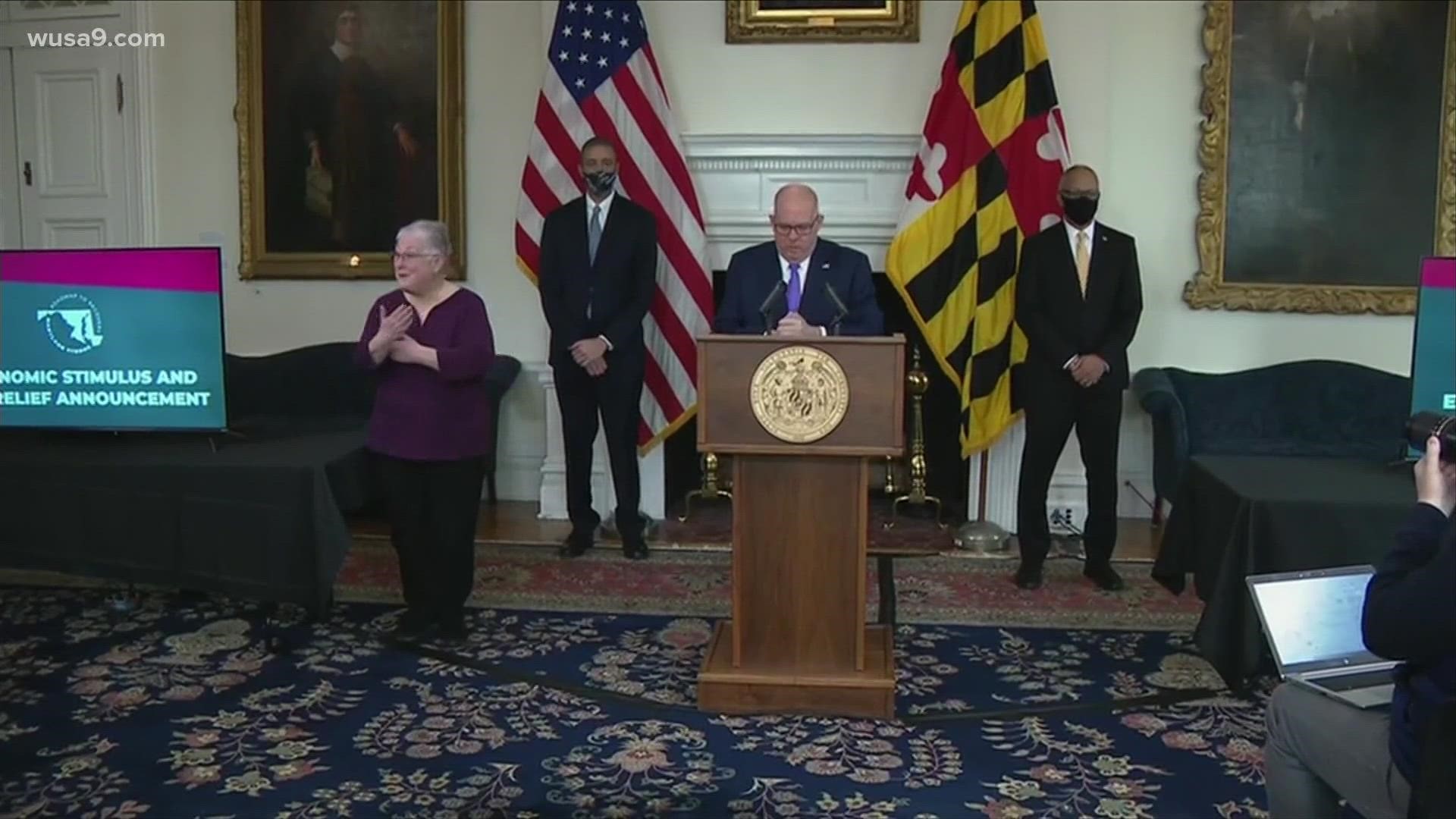

“It is clear to all of us that the primary focus of the 2021 legislative session must be providing additional immediate emergency relief to struggling Marylanders," Hogan said during a press conference Monday.

Provisions in the Recovery for the Economy, Livelihoods, Industries, Entrepreneurs and Families (RELIEF) Act of 2021 include:

- $267 million in direct payments to Marylanders in need – $450 for individuals and up to $750 for families – with no application necessary.

- $180 million to tax relief for unemployed Marylanders, including the repeal of all state income taxes on unemployment benefits.

- $300 million in tax relief for small businesses by creating a three-month period during which they can keep sales tax.

- Extension through all of 2021 of the governor's executive order protecting businesses from sudden increases in unemployment costs.

Hogan said the bill will also protect businesses against any tax increase triggered by the receipt of state loan or grant funds.

On Monday, Hogan said he plans to introduce the RELIEF Act of 2021 as emergency legislation to allow the legislature to act on it immediately. He said stimulus payments to individuals could begin going out as soon as it is passed.

“Struggling Marylanders and small businesses that are barely hanging on cannot afford the delay and partisan bickering that we’ve seen in Washington," Hogan said.

Maryland has already provided more than $700 million in state relief to businesses and individuals during the pandemic, including $220 million in grants and forgivable loans to small businesses and $80 million specifically for bars and restaurants.