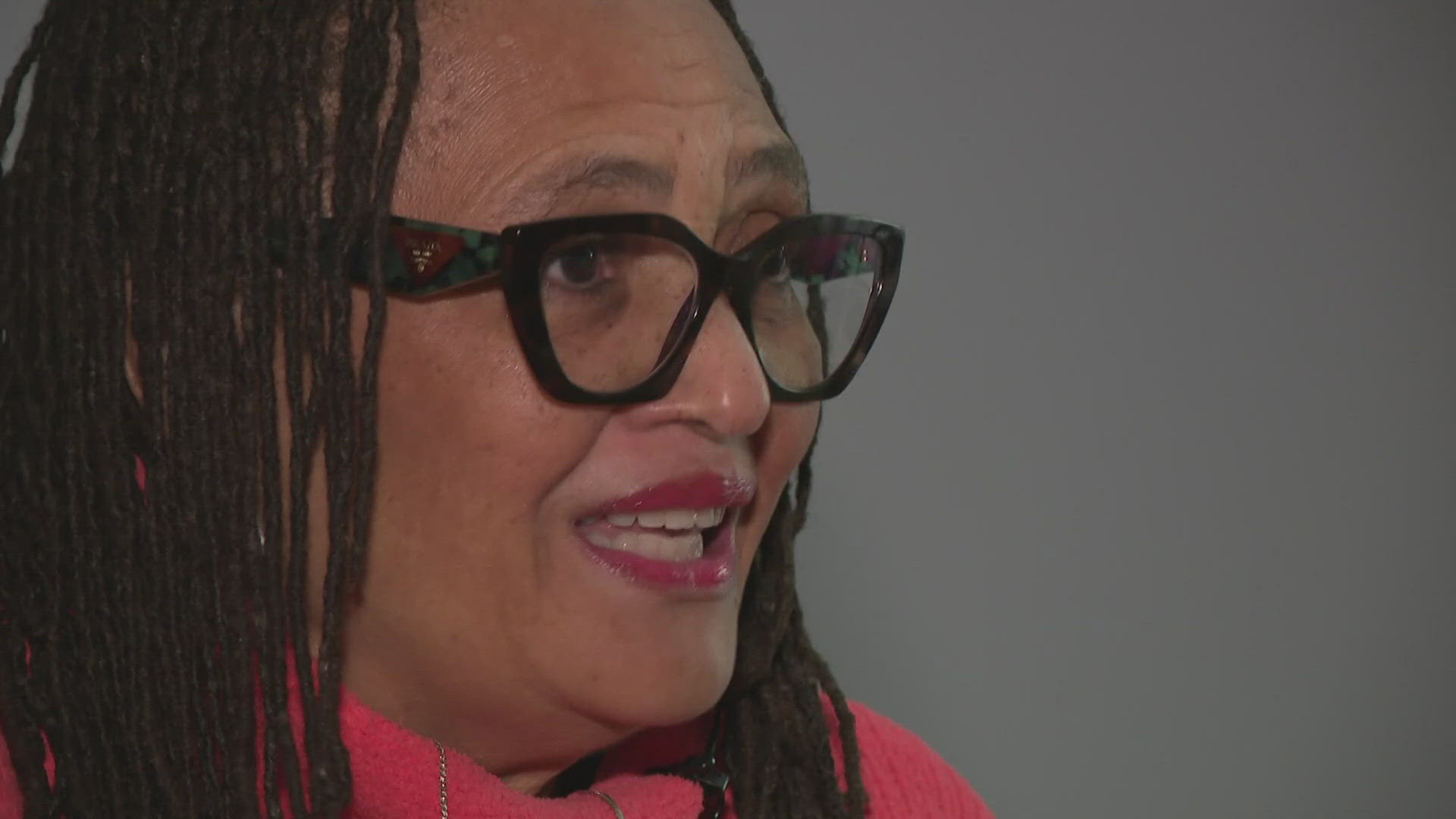

PRINCE GEORGE'S COUNTY, Md. — Sixty-six-year-old Patricia Monroe can describe every emotion she felt after watching Prince George's County agree to update a senior property tax credit.

“My heart, it just touched my heart," Patricia Monroe said.

The bill revises the county's existing Senior Property Tax Credit so residents older than 65, who have been living in the same house for at least 25 years are eligible for a 20% property tax for homes valued at $500,000 or less.

Homeowners would receive the tax credit for up to five years starting in 2025, if eligible. Councilmember Edward Burroughs III says the goal of the legislation is to ease the financial burden on older residents who may be struggling to afford their homes. The bill passed on Tuesday.

“I’m OK, but I know people that are not OK. and so that is why I went up there every time there was a hearing, and I thought because these people deserve it," Monroe said.

Patricia Monroe has helped lead the fight with about 200 other seniors who want this relief. Monroe lives in the South Lawn neighborhood in Oxon Hill, where she said there are a lot of other neighbors who have retired and have been around since 1955.

“People don’t understand, 20%, that’s the difference in you being able to buy groceries, put gas in your car, buy medications," Monroe said. "It means a lot.”

Monroe said, lately, she’s seen some of her longtime neighbors leave.

“It was heart wrenching," Monroe said. "It hurt me for somebody who had been here 30 years had to move. because they could no longer stay, because they couldn’t afford the taxes.”

Monroe thanks Burroughs III for the work he's done when it come to this legislation.

“A few months ago, I heard about a 99-year-old former teacher in my district who could no longer afford her property taxes. She and her family were worried about whether she could keep her home,” Councilmember Burroughs said. “It’s our responsibility to support senior citizens who have worked so hard to build this county, and I know this bill will provide some much-needed relief.”

Any seniors who were previously eligible for a tax credit under the prior 10-year requirement will remain eligible for the remaining years of their existing tax credit.

“People call it entitlement. It’s not entitlement, it’s not entitlement. We’ve worked hard," Monroe said.

Before the revision, many seniors couldn't take advantage of the Senior Property Tax Credit, if they were also receiving benefits from the Homestead or Maryland Homeowners' Property Tax Credit Program. The new bill ensures that seniors can use both at the same time as this the new law is separate from other property tax credits offered in Maryland.