MARYLAND, USA — We’ve been talking a lot about the program that will wipe out thousands of dollars in student debt for millions of people with federal loans. For Maryland taxpayers, more relief is available.

THE QUESTION:

What is the Maryland Student Loan Debt Relief Tax Credit, who's eligible, and how do I apply?

THE SOURCES:

WHAT WE FOUND:

The first thing to know: There’s a looming deadline. You have just two more weeks to apply – if this applies to you.

Maryland taxpayers who’ve incurred at least $20,000 in debt for undergraduate or graduate student loans, and still owe at least $5,000 in outstanding student debt, are encouraged to complete the Student Loan Debt Relief Tax Credit application, which is due September 15, 2022. Applying online is highly encouraged: you can do so here.

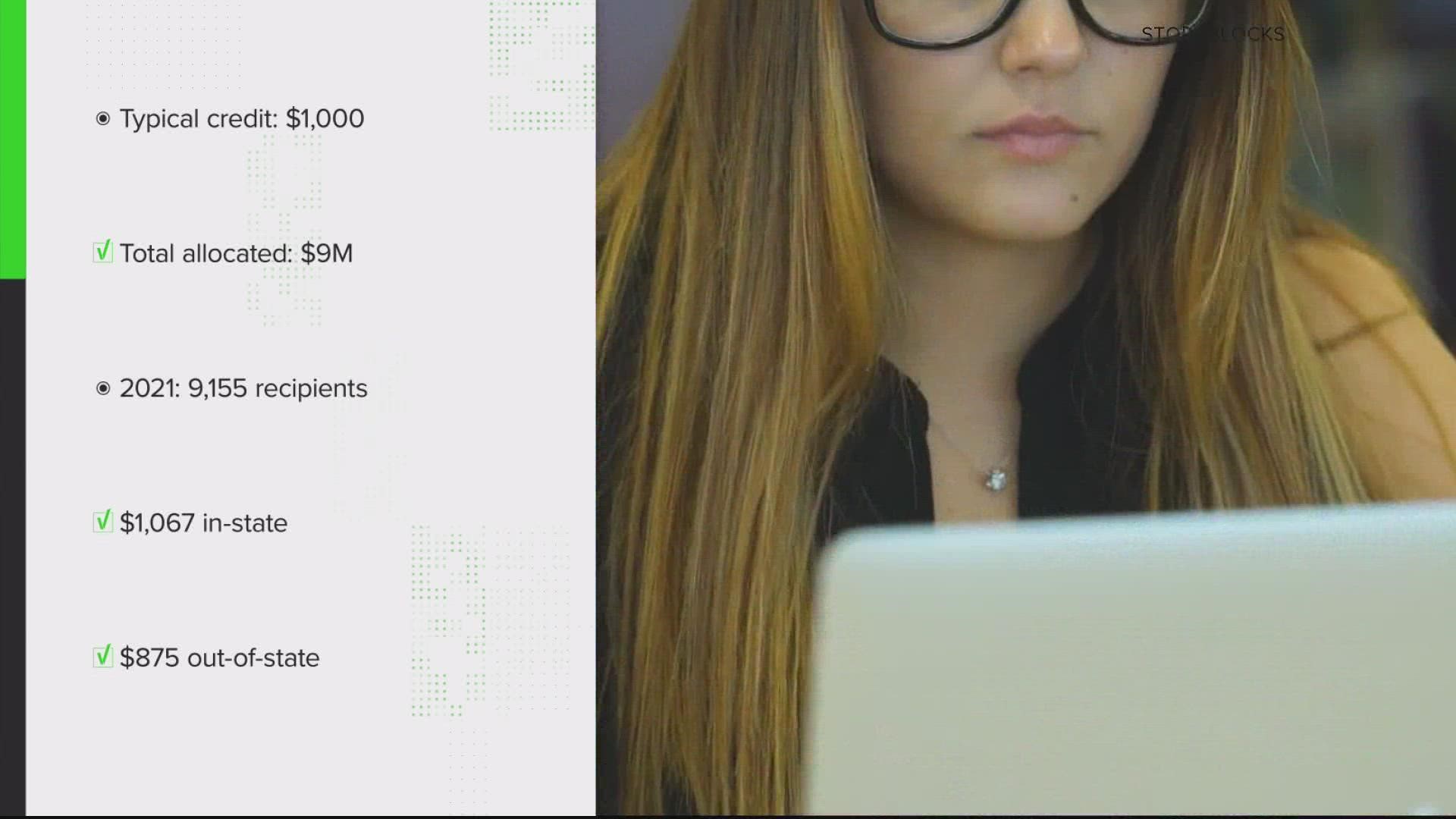

According to the Comptroller’s office, more than 9,155 Marylanders received the credit in 2021. People who went to in-state institutions received $1,067 in tax credits, while those who went out-of-state received $875 in credits.

The Higher Education Commission (HEC) says recipients typically get about $1,000 of the $9 million allocated by the state for the credit.

The HEC says on its website that priority goes to those who didn’t receive a tax credit in a prior year, were eligible for in-state tuition, graduated from a college or university in Maryland, and have a higher debt burden relative to their income.

RELATED: No, the average taxpayer will not have to pay $2,100 to cover the cost of student loan forgiveness

As a reminder about tax credits: whatever you owe in state taxes will be deducted from this; if you don’t owe anything though, you’d get the full amount sent to you.

If you take advantage of this credit, you need to provide proof to the Higher Education Commission that it went to paying off debt, otherwise you might have to re-pay whatever money you received.