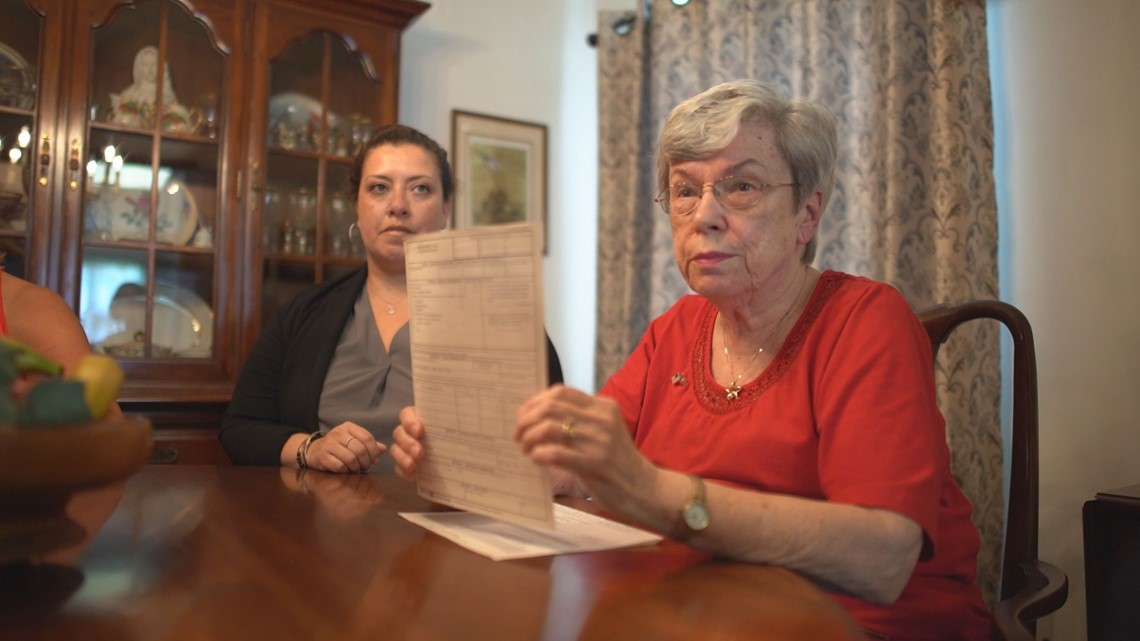

WASHINGTON — It’s a story WUSA9 first shared you with earlier this year. Annie Yu has been on the journey with surviving military spouses who have been battling decades to get back benefits that they earned.

Tonight, some 65,000 surviving military spouses have a lot to celebrate.

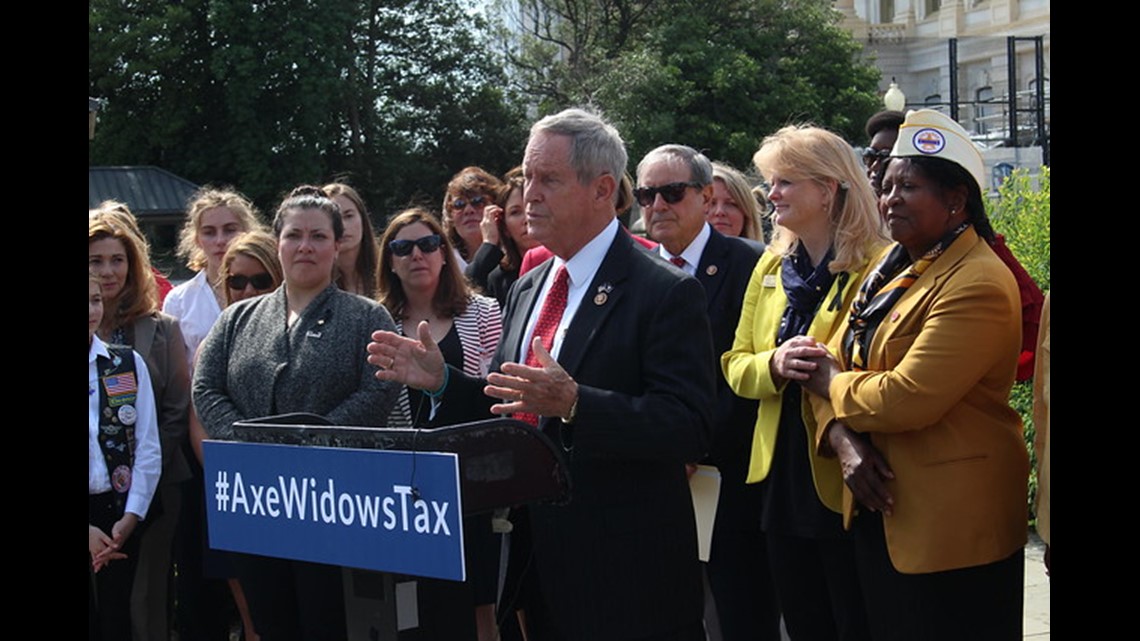

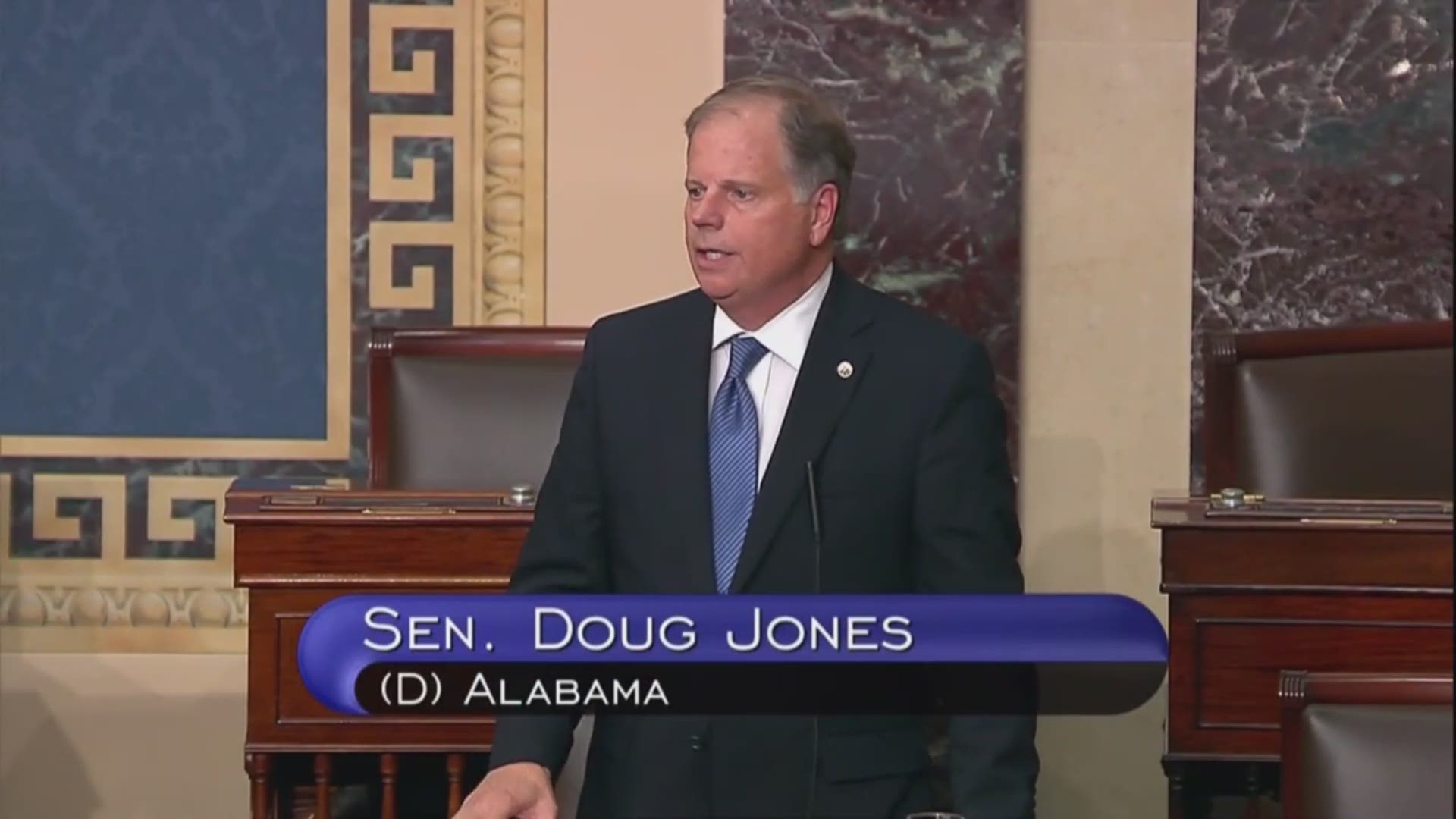

Legislation to repeal the SBP DIC Offset, better known as the "Widow’s Tax," was passed by committee conferees negotiating the budget for the military in the National Defense Authorization Act for 2020.

The elimination of the "Widow’s Tax" will be phased in over a three-year period, starting on Jan. 1, 2021. Surviving military spouses can expect to receive their full benefits by Jan. 1, 2023.

For survivors who took the child-only option, they will continue to receive both the SBP and DIC, without the offset money subtracted from their survival benefits.

But those spouses will be able to re-select to receive the survivor benefit plan in their name permanently Jan. 1, 2023, which is when the child option will be phased out. For spouses whose children have aged out, they too will be able to re-select to receive full benefits Jan. 1, 2023.

The full House and Senate will be voting on the legislation within the week, after which it goes to the president for his signature.