PRINCE WILLIAM COUNTY, Va. — Prince William County is extending the due date for residents' car tax bills.

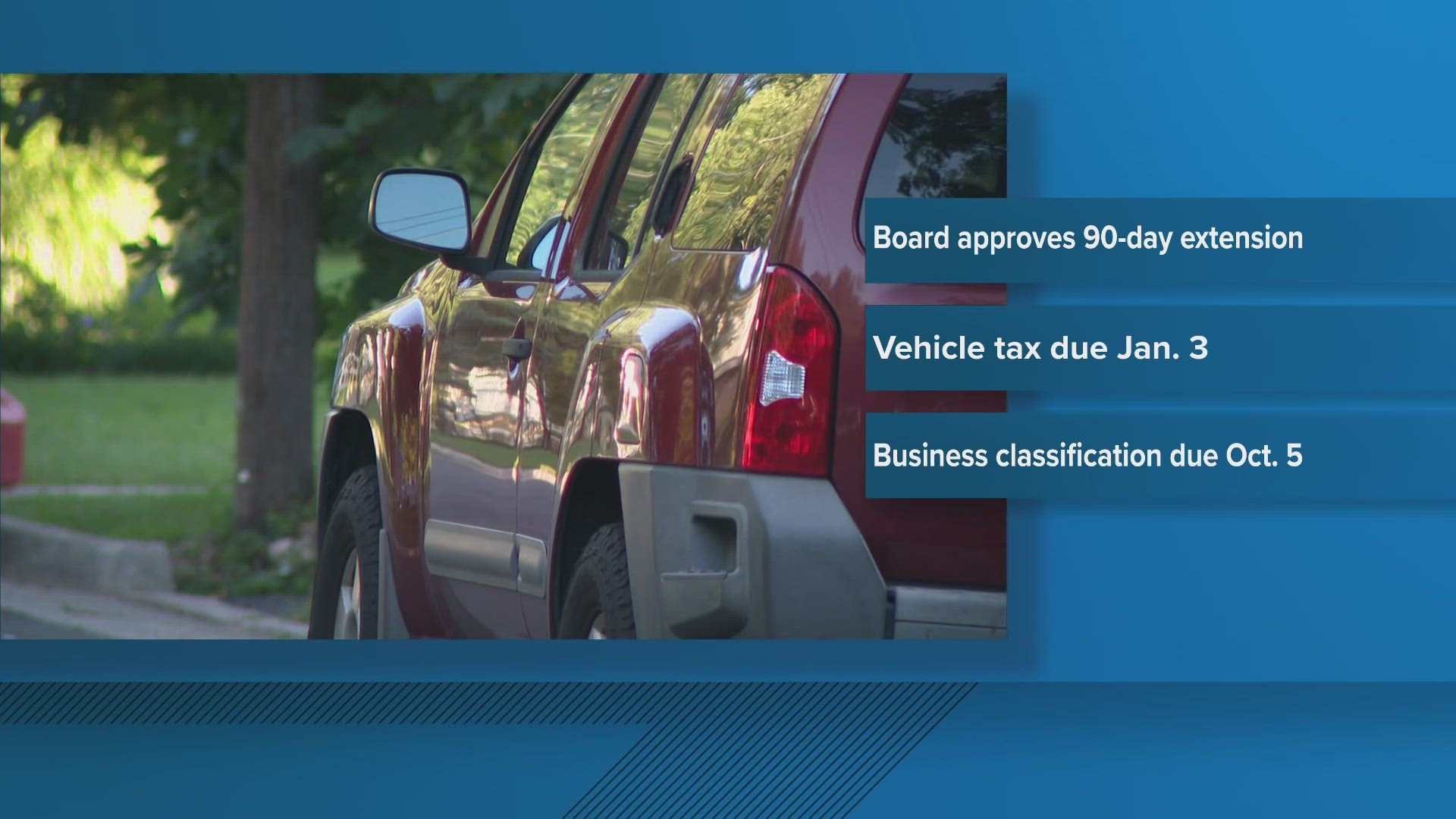

On Tuesday the Board of County Supervisors voted unanimously to extend the tax payment due date for the vehicle classification tangible personal property tax by 90 days. Typically, these payments are due by Oct. 5 each calendar year.

The county approved switching the deadline to Jan. 3, 2024. However, this extension exclusively applies to personal vehicles and does not impact business-classified vehicles. The property tax on those cars is still due on Oct. 5, 2023.

What brought on this sudden change you may ask? Well, the decision comes as a change in the vehicle assessment policy from 2022 began assessing vehicles at 80% of their value rather than 100% as it’s done in previous years. This was due to an abnormal surge in new and used car prices, supply chain disruptions, and computer chip shortages linked to COVID-19. However, in 2023 the county reverted back to the standard 100% assessment ratio since the car market is stabilizing.

In Virginia, the code specifies that, for most vehicles, the value be (1) from a recognized pricing guide, (2) applied uniformly, and (3) as of Jan. 1 of the tax year. Prince William County uses JD Power (NADA) to value the vehicles.

WUSA9’s Matthew Torres covered this problem over in Fairfax County, speaking to residents who were overwhelmed by their car tax bill this year.

“I thought it was a mistake,” Marie Cheek said. “We can swing it this time but between the housing taxes and the tax on our vehicles, they're pricing us out. We're almost 70 years old and both getting ready to retire in a year or so, we hope.”

A rep from Prince William County spoke with us to explain why they decided to return to the 100% assessment.

“The Commonwealth of Virginia provides personal property tax relief (Personal Property Tax Relief Act - PPTRA) to the county in the form of one lump sum each year. That amount does not change from year to year, and that relief is equally distributed amongst vehicle owners in the county. Therefore, the percentage of PPTRA reduces as more cars are registered in the county.” said Prince William County Communications Director Nikki Brown.

Recognizing the challenges posed by this transition, particularly given the declining tax relief from the Commonwealth of Virginia under the Personal Property Tax Relief Act, the Board extended the payment deadline. This extension aims to alleviate the financial burden on taxpayers in the face of high inflation and pandemic recovery efforts by granting additional time to accumulate the necessary funds for payment.

In February, a study showed that Virginia car owners are paying the highest average vehicle property tax in the country.