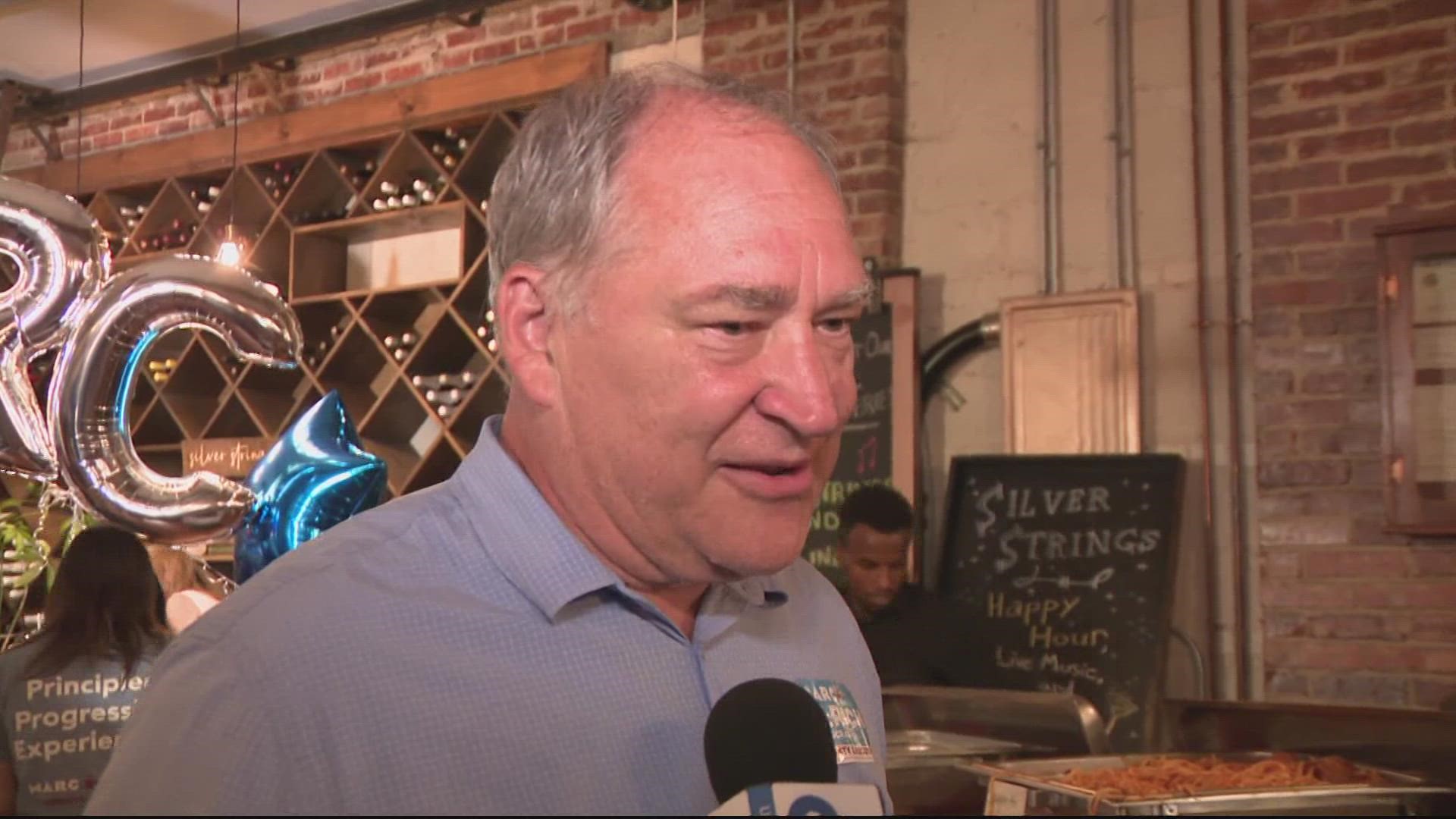

ROCKVILLE, Md. — Montgomery County Executive Marc Elrich says new commercial taxation districts are needed to stay competitive with Northern Virginia's public infrastructure and transportation system growth.

Elrich talked about his ideas Tuesday as he revealed the county’s latest capital budget proposal.

The $5.8 billion budget proposal includes billions in school renovations, transportation projects and items such as a new police station in Clarksburg, but a number of priorities have been trimmed back.

Elrich said the county is losing major development opportunities because there’s still not enough money to build out big transportation projects in a timely fashion. Many of the projects rely on state funding that is allocated on a different set of priorities, Elrich said.

Elrich believes commercial property owners and businesses would get a much better bang for their tax dollars if Montgomery County could create special commercial property taxation districts to pay for transit, roads and other infrastructure that the state of Maryland is not willing to pay for.

It's a model adopted by Northern Virginia jurisdictions such as Fairfax County which has a 12.5-cent commercial property tax levy dedicated to transportation and infrastructure projects to support new development.

"For everybody who's saying 'look at Virginia' and 'why don’t we do like Virginia,' we're not like Virginia because we've had no foresight," Elrich said. "People are absolutely unwilling to consider anything that would tax developers, God forbid. And if you’re not doing that, your basically dead in the water."

Elrich says Montgomery County should repeal one-time impact fees paid upfront by developers to fund transportation projects in favor of a special local commercial property tax that would cover 30-year construction bonds. That way the county could build out projects like its planned bus rapid transit system quickly without waiting for state funding.

Elrich said the conversation has heated up since Maryland Gov. Wes Moore has warned counties to expect big transportation project cuts because of the state’s own budget problems.

The authority to create local special taxation districts must be granted by legislation approved by the Maryland General Assembly and the governor.

So far, no bill has been introduced.