MARYLAND, USA — Maryland Governor Larry Hogan announced on Monday that both Maryland Democrats and Republicans had agreed on "the largest tax cut package in state history" that will provide savings to retirees, small businesses, and low-income families over the next five years.

In total, Gov. Hogan said the tax cuts bring around $2 billion in tax relief when combined with the recent suspension of the gas tax.

Under the terms of the deal, retirees making up to $100,000 in retirement income or married couples making up to $150,000 in retirement income will have state income taxes significantly reduced or erased altogether.

According to the governor, 80% of retirees in Maryland will be impacted by the plan, which could save them around a combined $1.55 billion.

"Cutting our state’s retirement taxes is something we have been trying to accomplish for seven years, and I want to thank the leaders of the General Assembly for working with us to get this done for Maryland’s seniors," the governor said in a statement on Monday. "This agreement will deliver on our promise to provide real, long-term relief for hard-working Marylanders dealing with inflation and higher prices, and help create more jobs and more opportunity to continue our strong recovery.”

House Speaker Adrienne Jones (D-Baltimore Co.) and Senate President Bill Ferguson (D-Baltimore City) also voiced support for the measure and said it would help many Marylanders.

Aside from retirees, families in the state will see relief.

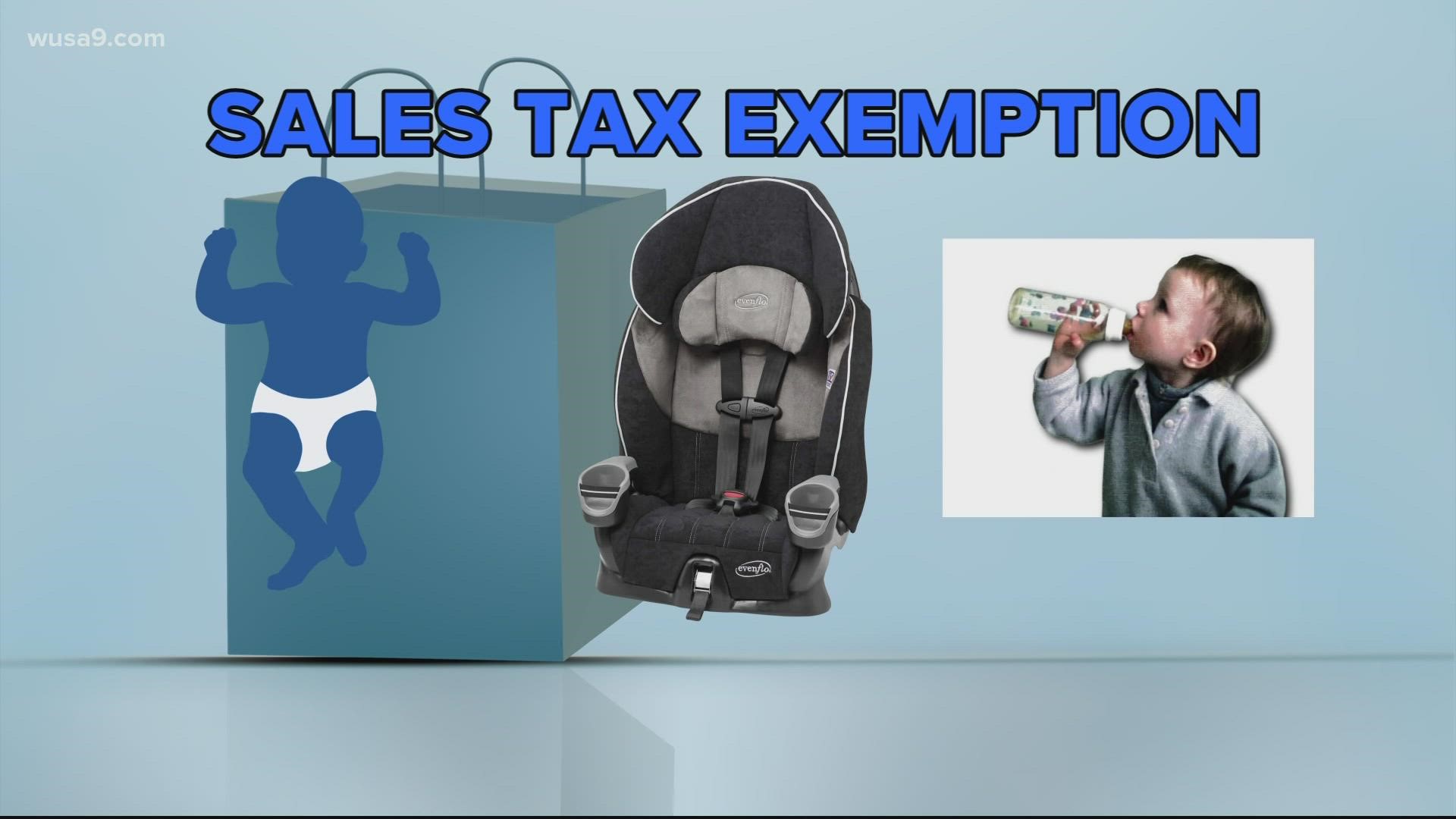

Sales tax will be exempted for child care products like diapers, car seats, and baby bottles. According to the governor, the change will help people save a combined $115.6 million.

On Monday, Montgomery County Parents of Multiples President Larry Paska said the tax relief would make a big difference for moms and dads around Maryland.

"Some of the car seats that you grow into when you’re four years old can run several hundred dollars," he said. "If you’re purchasing a lot of (baby items) on your own, it can run up to several hundred dollars a month. Even a sales tax of $10-20 a month on diapers really does add up.”

"Even eliminating $20-40 worth of sales tax puts food on the table for families," Paska added.

Under the Work Opportunity Tax Credit a part of the package, employers and businesses will be incentivized to hire and retain workers from "underserved communities that have faced significant barriers to employment."

Later this week, Governor Hogan plans to hold a special bill signing ceremony with Speaker Jones and President Ferguson focusing on the tax cuts.