MONTGOMERY COUNTY, Md. — Montgomery County Maryland residents are lining up to weigh in Monday night on a proposal to raise property taxes by 10%.

Montgomery County Council President Evan Glass said he doesn’t think taxes need to go up that much. Glass said there are 1,200 to 1,500 open positions in county government that don’t necessarily need to be filled. He's convinced that eliminating some of those jobs that are vacant anyway is one way to avoid raising property taxes in Montgomery County, while still being able to pour more money into schools.

"I am committed to meeting those needs, but I don't think we have to increase property taxes by 10% to meet those needs," Glass said. "That's why I'm leading the council to find other budget friendly, efficient ways of raising the revenue of redirecting revenue."

Glass said cutting empty police, fire, mental health and social worker positions is off the table.

“But there are also other positions that are analyst positions and certain managerial positions that have gone unfilled for years,” Glass pointed out.

The Council does not yet have an estimate of how many jobs can be cut or how much can be saved.

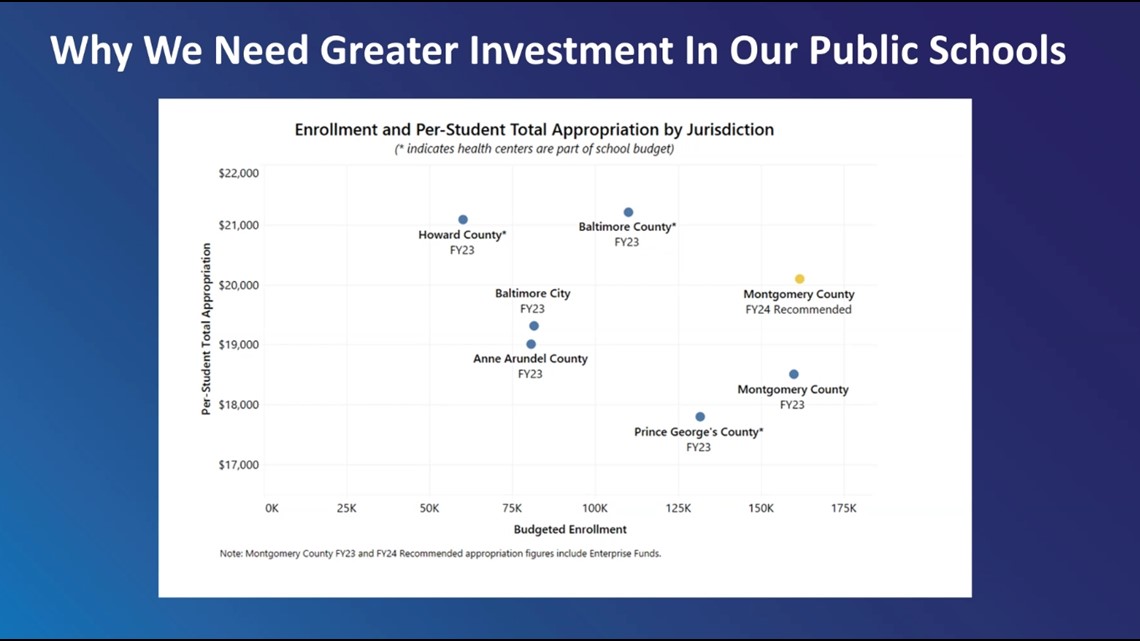

The 10% tax increase was proposed by County Executive Marc Elrich in March. He pointed out the school system is behind other major Maryland counties in per-pupil spending and that schools need nearly $300 million to catch up or risk students falling behind.

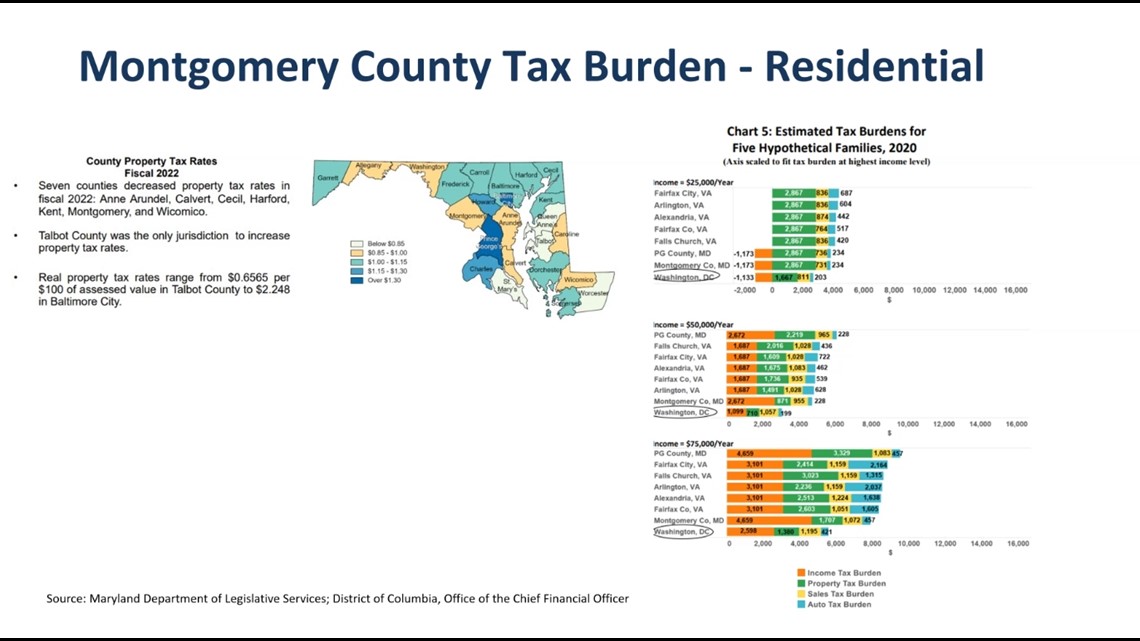

Elrich said county property taxes are relatively low compared to neighboring counties that are gaining population.

“People say that people are going to Howard County and Frederick County, both of whom have higher tax rates than we do," Elrich said. "Howard County’s property tax rate is $1.25 (per $1,000 in assessed value) and Frederick's is $1.06. We are 99 cents. So again, people aren't fleeing us over the taxes."

Elrich said failing to invest more in schools is what will cause people to move out, not a hike in property tax.

Monday night, a virtual forum was held to allow people to ask questions.

On resident asked why funding couldn't come from increasing income taxes instead.

"Property tax increase effects seriously low income and people on fixed incomes. Is there some reason why we can't consider raising the income tax on what's considered one of the wealthiest counties in the country?," they asked.

Chief Administrative Officer Richard Madaleno explained that they can't raise the income tax rate, because Maryland doesn't allow it. He told the 40 people on the call that Maryland's max income tax rate is 3.2%, and Montgomery County is already at the max rate.

"Like many of the counties around us, we are at the 3.2% level and can not even consider an increase in the income tax," said Madaleno.

The Montgomery County Council still has to vote on this proposal. To sign up to testify at their upcoming hearings, click here.