WASHINGTON — A new study evaluating the housing market found that wannabe D.C. buyers may need to invest significantly more than the traditionally recommended 20% down payment if they want to truly be able to afford their mortgage.

According to research done by real estate marketers at Zillow, households making the median income would need to put $188,087 down to afford a mortgage payment in D.C. That equates to a 33.1% down payment if you account for the typical D.C. home value being $568,862.

While the cash itself needed for D.C. homebuyers is higher than for the average American, the percentage of the down payment is actually slightly lower. A prospective buyer making the median income for the country needs to put down $127,743, or 35.4% of a house valued at $360,000, to comfortably afford the mortgage.

"Affording the mortgage" was calculated as a payment that is no more than 30% of the household's monthly income. Zillow research also found that if a household saves 10% of its income each month, with a 4% annual return, it would take D.C. buyers a little over 11 years to save enough for the needed down payment.

D.C. was far from an outlier in terms of whether a 20% down payment is enough. Only 10 of the 50 biggest U.S. markets would be able to comfortably afford mortgage payments with down payments of 20% or less. Pittsburgh was found to have the most affordable housing market.

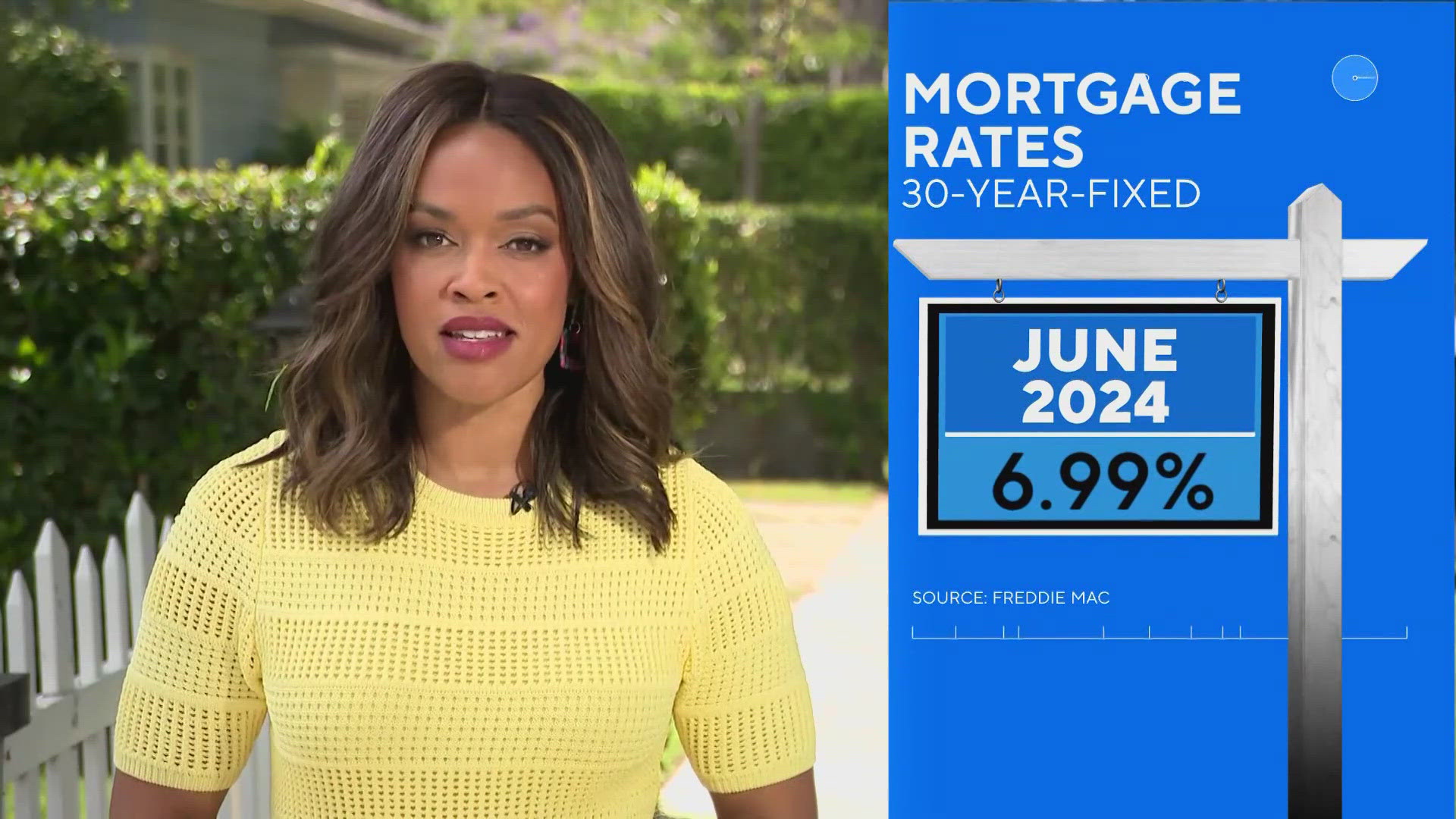

"Down payments have always been important, but even more so today," said Skylar Olsen, chief economist at Zillow. "With so few available, buyers may have to wait even longer for the right home to hit the market, especially now that buyers can afford less. Mortgage rate movements during that time could make the difference between affording that home and not."

The numbers underscore why buying without assistance has become virtually unattainable for many Americans. More than 40% of 2023 buyers used a gift from family or friends toward their down payment, Zillow says. That's the highest rate since 2018.

"Saving enough is a tall task without outside help — a gift from family or perhaps a stock windfall," Olsen said. "Down payment assistance is another great resource that is too often overlooked."

According to Down Payment Resource, the average down payment assistance for qualified D.C. buyers is a little more than $20k.

Do you have a news tip on this story or any other story? We want to hear from you. Tell us about it by emailing newstips@wusa9.com.

MORE WAYS TO GET WUSA9

DOWNLOAD THE WUSA9 APP

Apple App Store: WUSA9 News on Apple

Google Play Store: WUSA9 News on Android

HOW TO ADD THE FREE WUSA9+ APP TO YOUR STREAMING DEVICE

ROKU: add the channel from the ROKU store or by searching for WUSA9.

For both Apple TV and Fire TV, search for "WUSA9" to find the free app to add to your account. Another option for Fire TV is to have the app delivered directly to your Fire TV through Amazon.

SIGN UP TO RECEIVE WUSA9 NEWSLETTER

Subscribe to our daily WUSA9 Newsletter for top stories from WUSA9 curated daily just for you. Get content and information right now for can’t-miss stories, Commanders content, weather, and more delivered right to your inbox.