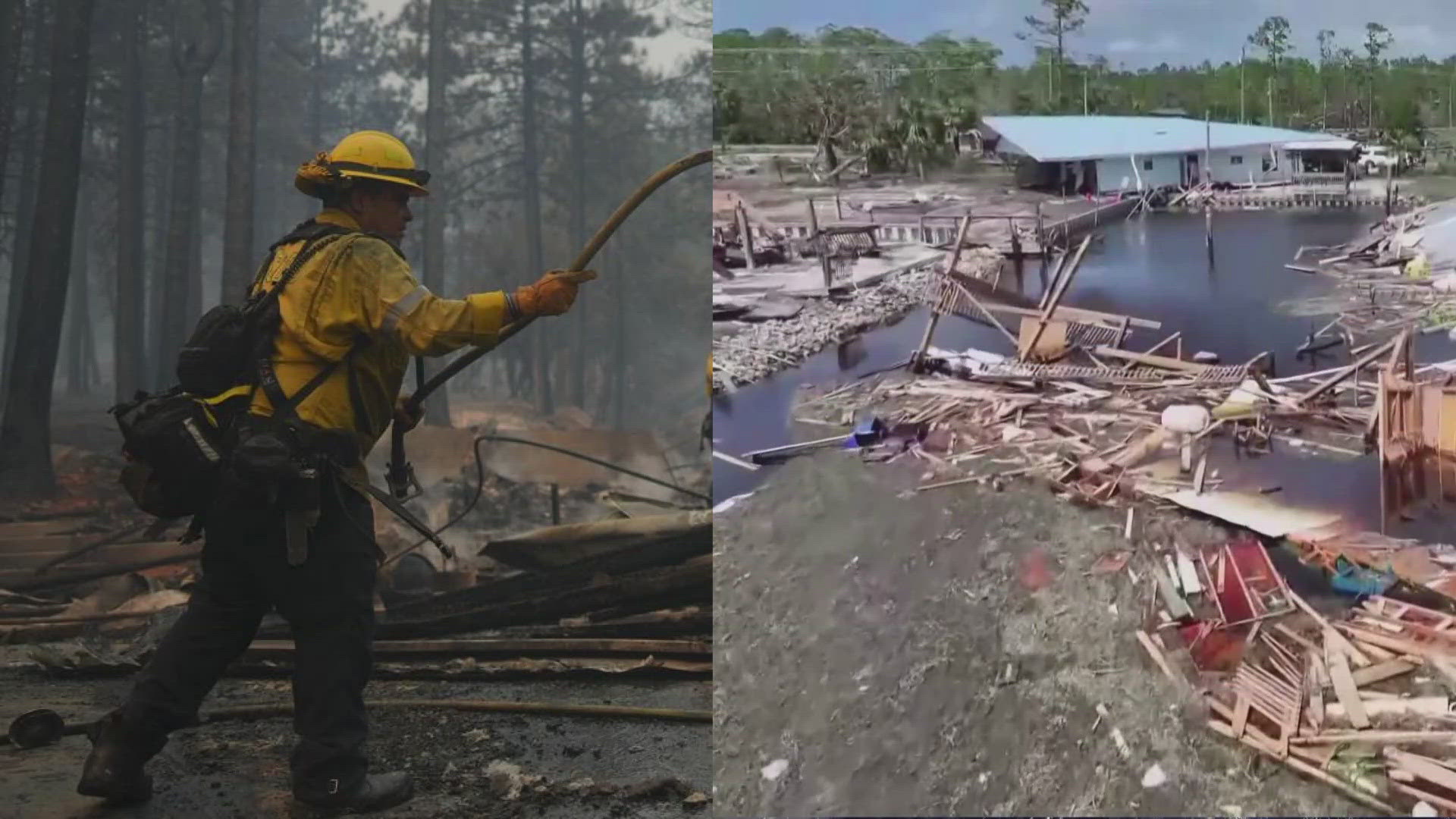

ASHEVILLE, N.C. — The sun was out Friday in the disaster areas of Florida and North Carolina, but the clean up is coming with some harsh financial realities.

Disaster policy experts say some property owners in both states may be forced to give up and move out for good, while the rest of Americans are likely to face even more hikes in insurance rates.

Homeowners insurance has shot up 20% nationwide since 2022 as one natural disaster after another continues to costs insurers billions.

“The insurance industry is under tremendous pressure from the increase in disasters that we're seeing," said Jeff Schelgelmilch, a scholar at Columbia University and the author of two books on disaster readiness, response and public policy.

He says back-to-back hurricanes are another wake up call.

“We have to be more honest with ourselves about what that's going to take up front," Schelgelmilch cautioned.

One significant issue that needs fixing is flood maps published by the Federal Emergency Management Agency.

The maps have not been updated to reflect new threats from climate change.

Mortgage lenders and insurance companies rely on the maps to judge risk. But less than 1% of the North Carolina flood victims had flood insurance, because they live in areas not identified by FEMA as flood zones.

A government bail-out for the uninsured victims may be required.

Meanwhile, many insurers are now refusing to do business in states like California and Florida because of losses from fires and floods.

Florida has state-backed insurance, but the program is already in financial trouble.

Rates elsewhere, like in coastal communities in Maryland are seeing skyrocketing rates for some types of coverage.

Schelgelmilch says it’s an example of the costly disruption caused by climate change.

“If you can't get insurance, you can't get a loan. If you can't get a loan, you can't buy a house if you can't get a loan to buy a house, you can't sell your house. Then that has cascading effects."

Schelgelmilch said recent studies have not provided clear answers on long term strategies for flood recovery.

A key question: Should we retreat from areas exposed to hazards, or should we invest in extremely expensive additional infrastructure to defend against disasters.

"It turns out neither answer is right," Schelgelmilch said. "Some areas, it's just too expensive to stay. You have to move back. And others, there's too much infrastructure already there, and you have to build it up. So it's an elusive answer. And the other thing I would say, too, is you can't really outrun the hazards that we're facing.”

Losses from Helene and Milton combined are likely to reach well over $80 billion, according to widely varying estimates.

More upward pressure on insurance premiums for all Americans is the likely outcome.