WASHINGTON — As D.C. residents begin filing taxes, tens of thousands of families will be automatically enrolled in the District's new Monthly Basic Income program and begin receiving a monthly check.

According to Councilmember Charles Allen, there are thousands of law-wage residents who are eligible for the program, but who may be leaving money on the table because they don't file taxes, thinking they don't owe money.

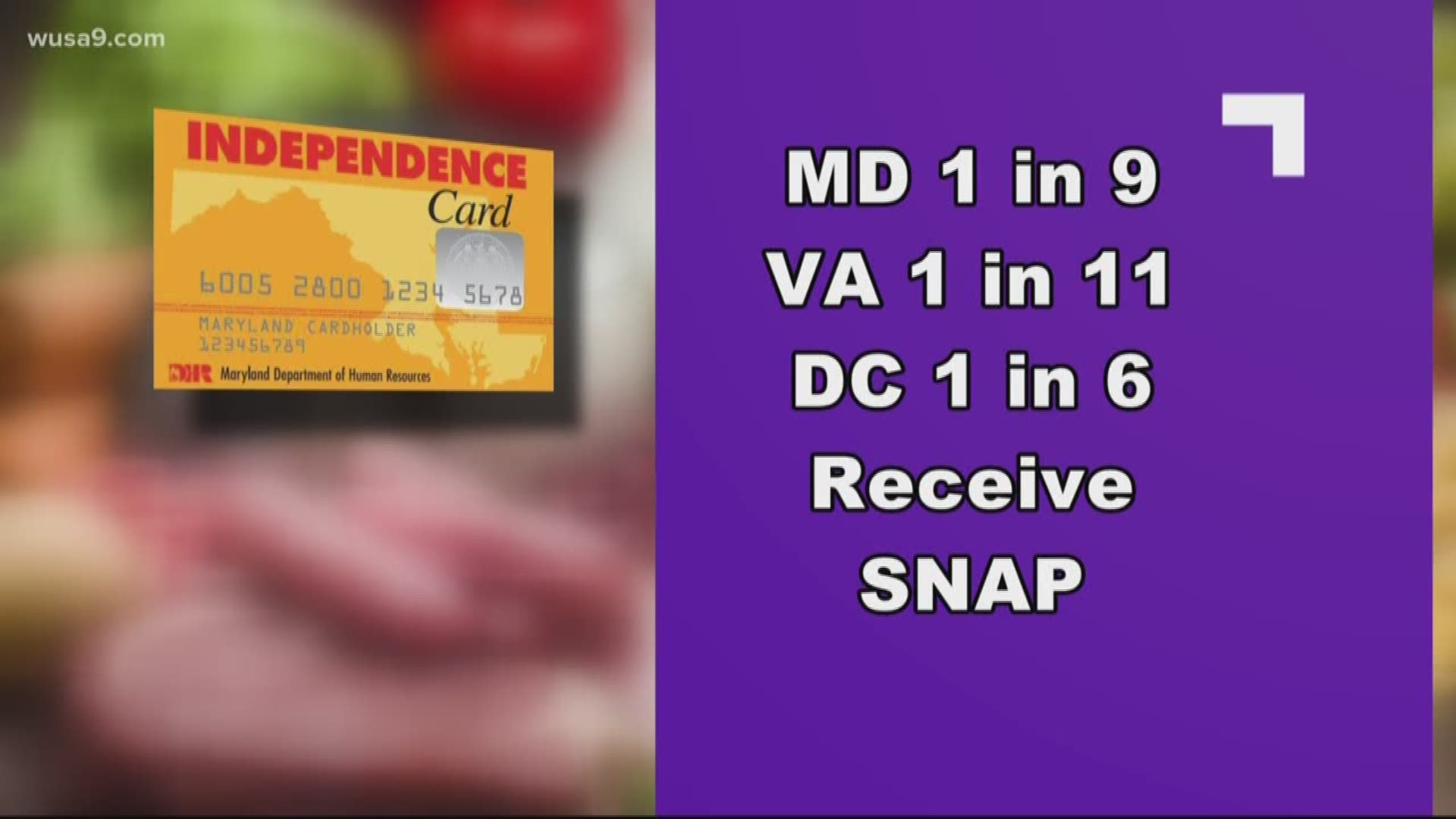

The launch of the Monthly Basic Income program comes as the federal government is reducing SNAP benefits for families nationwide. The boosted benefits were enacted as part of COVID pandemic relief. SNAP Emergency Allotments will end March 1, returning many household’s SNAP benefits to pre-pandemic levels. The average family is expected to lose $82 a month from their benefits.

Allen said the new Monthly Basic Income program could help buffer some of that loss.

“This has the potential to be one of the most important policies to go into effect in recent years in the District,” Allen said. “This isn’t a pilot program or an experiment. We know providing extra funds to families who have desperately few resources can have enormous benefits for everyone. And while I wish that the federal government would maintain SNAP benefits at higher levels, I am glad this is coming online at this moment to soften the blow.”

Allen created the Monthly Basic Income program as part of the Homes and Hearts Amendment in July 2021. Starting this year, enrolled low-income families (think less than $60,000 annually for a family of four) can start receiving a check.

Currently, there is a local, District-funded match for the federal Earned Income Tax Credit that is issued annually. That local match helps increase the return for low-income families who file a return.

To enroll, eligible families just need to file their taxes and apply for and receive the EITC. Depending on an applicant’s income and family size, they could receive $50-250 a month this year, with that amount set to increase in the coming years to as much as $500 a month.