ROCKVILLE, Md. — You’ll want to check your bank accounts Thursday if you have kids. Families will receive the new advanced Child Tax Credit payments starting on July 15 and going through December. Now, WUSA9 is bringing you the stories behind these payments and why local families could use the extra boost.

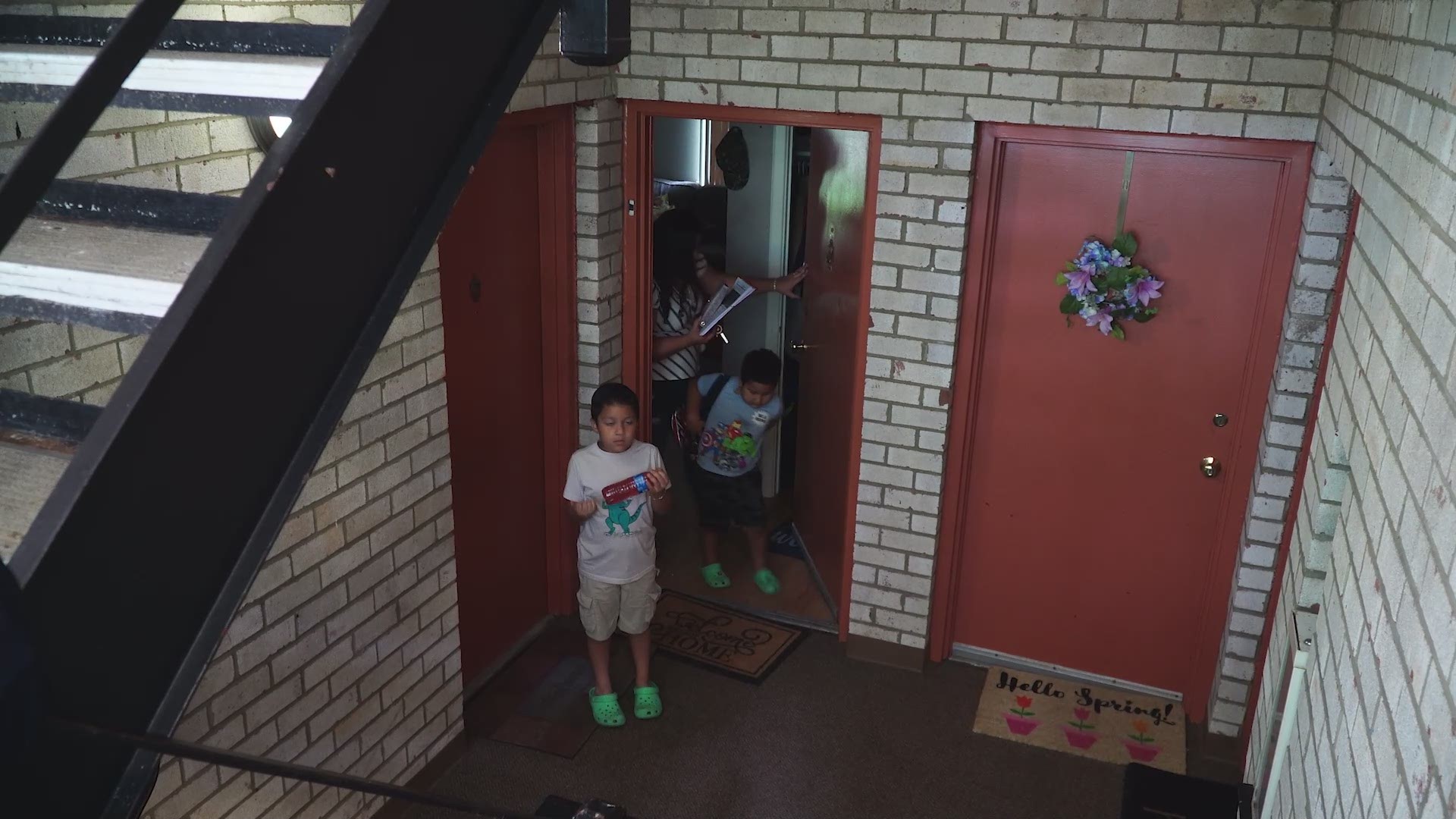

Yoslin Amaya’s conversation with her 4-year-old son is one many working parents can likely relate to amid the return to work from the pandemic. He asked why they have to leave the house. “Because I have to work,” she responded.

What James might not understand yet are the fears about finding and keeping work, which keep Yoslin up at night.

“When we were budgeting everything out, we actually found out that we only have about $100 to $200 leftover each month,” she said. "If we found ourselves in any emergency, you know, where are we going to get the money?”

Yoslin and her husband Fermin have done what they can to create better lives for their children in Montgomery County.

Fermin works and goes to school, while Yoslin just got her college degree and is working two jobs. She had been working nights as a janitor while her husband works days, which was the only way they could make ends meet to avoid the major expense of child care.

“While my husband was working during the day, I was with the kids babysitting them. And then when he would come home, he would babysit them and I would go to work,” Yoslin said.

Yoslin hopes to get a better day job now that she's got her college degree, but she needs this extra relief to be able to afford child care and work during the daytime.

“That would allow me to continue working,” she said. “That would allow me to stay in the workforce.”

The Child Tax Credit already existed, but this year Congress increased the amount. Lawmakers are also allowing parents to get some payments upfront to help them immediately, instead of waiting until tax time.

Here's how it breaks down.

Parents will get half of the increased credit in monthly payments for the rest of this year. Those who qualify for the full amount will get $300 per month for kids under six and $250 a month for kids six through 17.

Parents will get the other half of the money when they file their 2021 tax return and claim the credit.

We asked Maryland Congressman David Trone what he would say to skeptics who believe this is another government handout.

“These folks are struggling, but they all want to get ahead and they’re being held back because they can’t get out of the house to build a career, build a job and move forward,” Trone said. “And they want a better life for their kids and they need to do that. This is going to let them do that.”

The big question now is whether or not they'll be able to extend this increase in the Child Tax Credit beyond 2021 through 2025. But does the government have enough money to find this?

“At some point in time, we agree we need to get the budget back more in balance,” Trone responded. “Right now, we've got to get out of COVID, turn this economy around, and then focus on those that have the least and that's what this credit does.”

For Yoslin, expansion of this credit isn't just money in her pocket, but a concrete solution to problems many families have.

“They would be able to provide a lot more relief to families like me, like my husband, like my kids, who are living paycheck to paycheck, because I would say we are living paycheck to paycheck,” she said.

The first payment comes Thursday, July 15, then August 13, and then the 15th of each month through the end of 2021.

Sign up for the Get Up DC newsletter: Your forecast. Your commute. Your news.

Sign up for the Capitol Breach email newsletter, delivering the latest breaking news and a roundup of the investigation into the Capitol Riots on Jan. 6, 2021.