MITCHELLVILLE, Md. — “How are we going to pass down inheritance to our children and children’s children?”

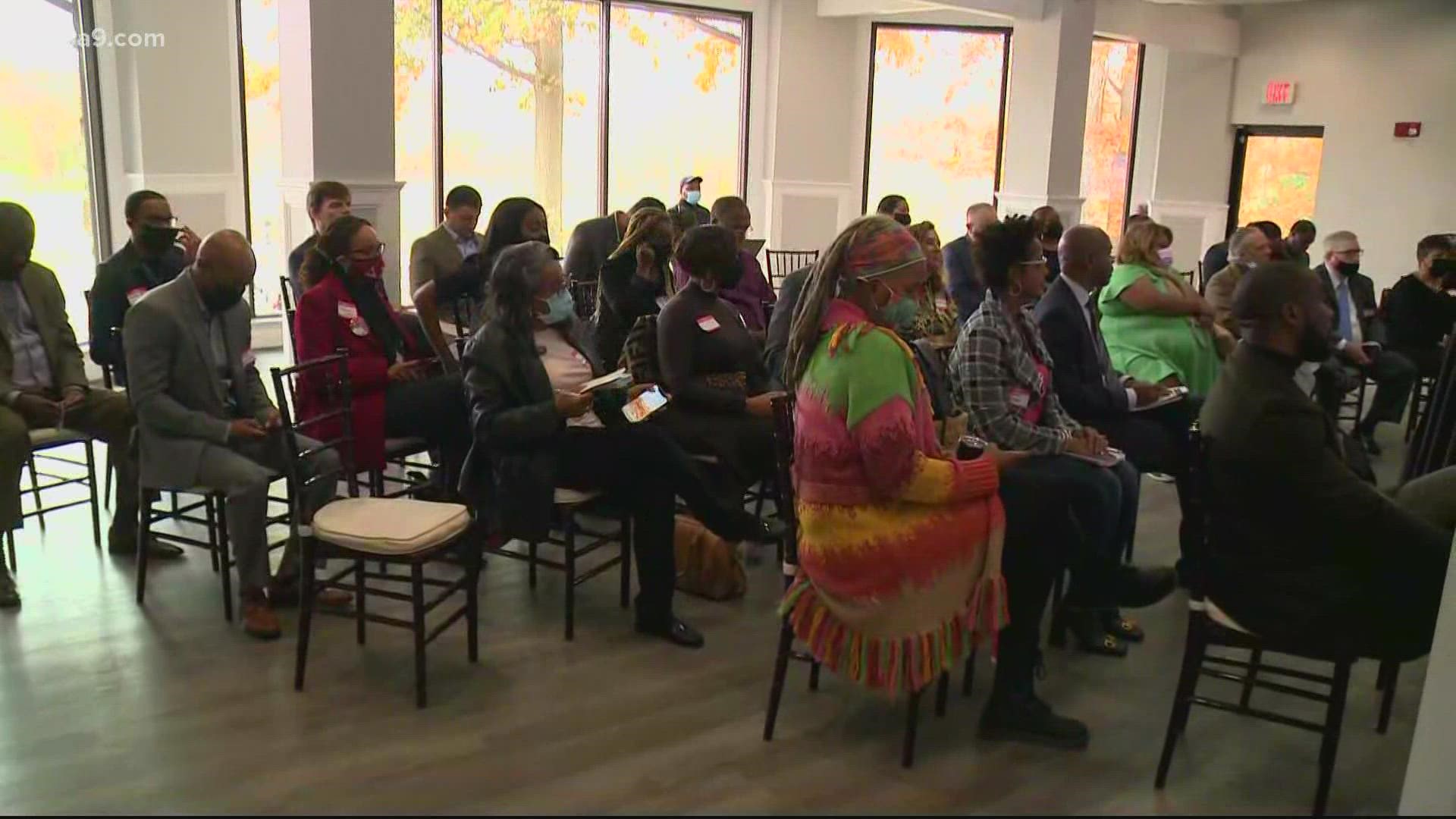

A group of stakeholders -- including homeowners, real estate agents, appraisers and brokers -- faced questions like this one at Wednesday’s Fair and Unbiased Appraisal Advocates roundtable held at the Country Club at Woodmore. The meeting came on the heels of a WUSA9 investigation on why some homes in Prince George’s County are appraised differently than others, leading to lower valuations and ultimately lower wealth accumulation.

Two families who spoke with WUSA9 say they lost thousands of dollars because their homes were appraised differently. They believe their houses were valued differently because they are black homeowners in a black-majority neighborhood.

“It’s pervasive. I’ve been fighting appraisal values for years,” said Angelique Best a mortgage broker for over 20 years. “After the market crashed and Dodd Frank came out ... when we order an appraisal, we have to order it through the lender’s appraisal management company. So, we don’t have any relationship with the appraiser. We don’t even know who what appraiser is or even where they’re coming from.”

The Dodd-Frank Wall Street Reform and Consumer Protection Act passed in 2010. The bill overhauled financial regulations and put in place safeguards to ensure what led to the 2008 crash did not happen again.

“There may be some racial issues,” admitted Best, explaining why lower than expected appraisals appear to be an ongoing issue in Prince George’s County. “I’m not going to even deny that maybe [racial issues] are a big piece of it. So, consequently, when you have an appraiser that comes in low, it's extremely difficult to argue.”

Research from the Brookings Institute shows that homes in black neighborhoods are devalued by about $48,000 on average. That average was on pair with what WUSA9 found when we examined their data for the Washington metro.

Ayako Marsh has seen the problem on the ground as an appraiser for the last 22 years.

“We have to understand the bias is unintentional,” Marsh said. “Now if it’s done intentional[ly], that equates to racism.”

RELATED: WUSA9 investigation into Prince George’s home appraisals leads to calls for state-level review

Marsh adds that the issue is complex. The types of appraisals conducted may affect the value of the home, whether it be a cost approach, sales comparison, or income comparison. Also, homeowners may believe that certain upgrades improve their home’s value—when in fact they do not.

Marsh added that it doesn't help that Black appraisers make up just 2% of the total workforce.

“We need appraisers to also look like the community that we are appraising," Marsh said, arguing that having more appraisers of color will also help address appraisal bias.

For information on what appraisers consider during an appraisal, check out the video below: