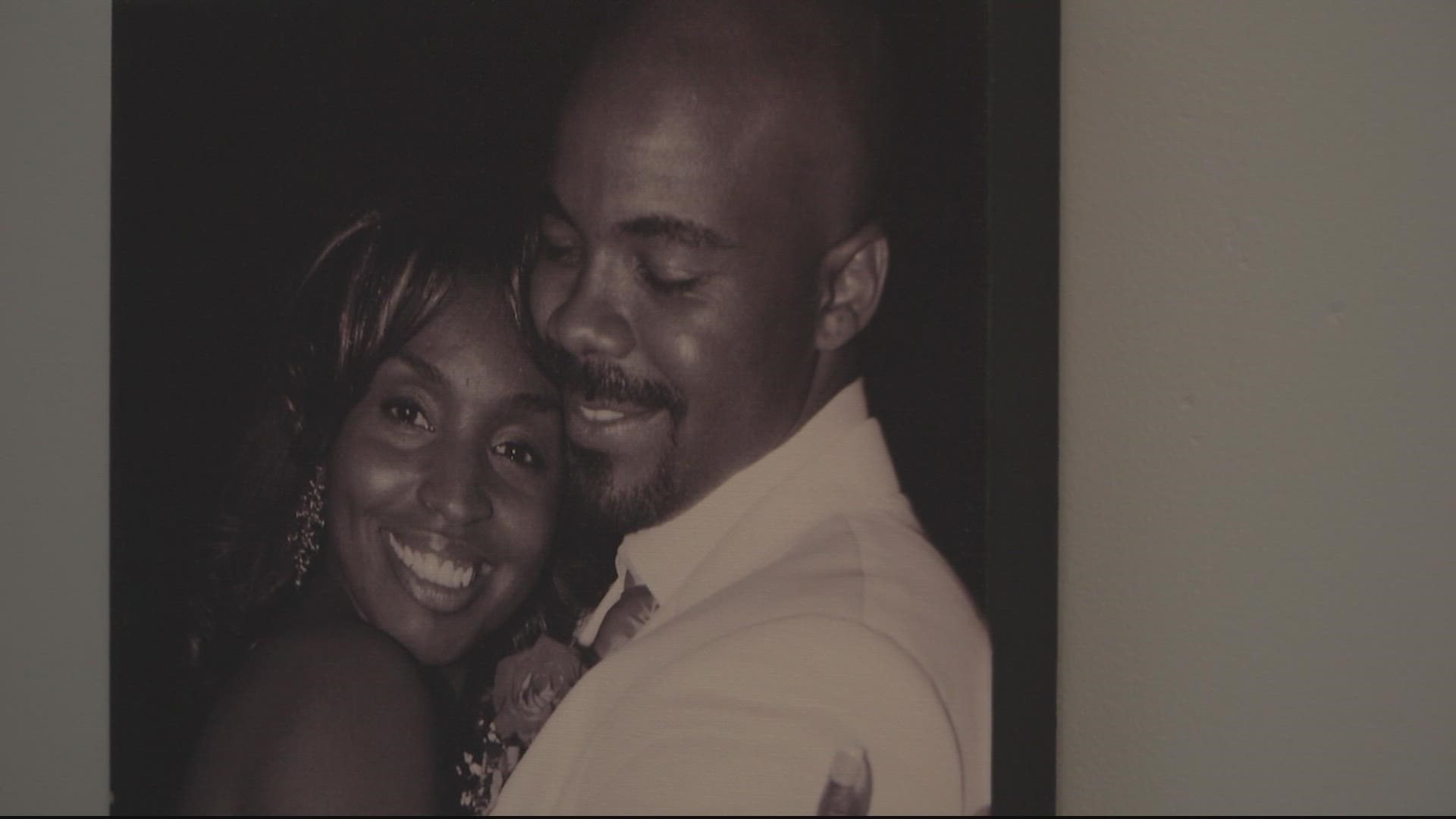

PRINCE GEORGE'S COUNTY, Md. — Dr. Nathan Connolly and Dr. Shani Mott are speaking out after the couple filed a lawsuit against 20/20 Valuations, its owner, and loanDepot for alleged violation of their rights.

In their lawsuit filed last week, the couple said the owner of 20/20 Valuations devalued their 4-bedroom, renovated home because they’re a Black family in a mostly white neighborhood.

“The idea that the life we built in this house would somehow devalue our property was just too hard for us to accept,” said Dr. Connolly, a professor at Johns Hopkins University who teaches the history of redlining in the United States. “This is really common and people are developing a language to talk about it.”

Like many Americans, the couple was looking to take advantage of historically low-interest rates last year. After spending $35,000 dollars on renovations, the couple decided to refinance their home.

"Plaintiffs also spent significant amount of money on other repairs and improvements, including $5,000 on window well repair and waterproofing; $8,000 on recessed lighting; and $5,000 in landscaping," the lawsuit stated.

The couple filed an application with loanDepot, a California Based Mortgage Company. The couple claimed in their lawsuit that everything went well and the loan officer expected the house to appraise at $550,000.

“[The lending officer] believed $550,000 was a conservative estimate of the value….and that an appraisal would likely reflect an even higher value,” the lawsuit stated.

When the appraiser from 20/20 Valuations arrived at the house, the couple said the problems began.

“When he came to our home, he felt cold,” said Dr. Mott, also a professor at Johns Hopkins University, describing her interaction with the appraiser from 20/20 Valuations whom she met for the first time in her home.

After the appraisal, the couple packed up for a family road trip down to Florida for vacation. That’s when they got the call.

“The guy from loanDepot called us,” explained Mott. “He let us know the value of the house was $472,000.”

The couple says they purchased the home for $450,000 in 2017. Given the renovations, money invested and the market, Dr. Connolly and Dr. Mott said the appraised value from 20/20 Valuation does not accurately reflect the value of their home.

"Plaintiffs explained that there is a long and well document history of devaluing Black homes and that the valuation was impossibly low given the characteristics of their neighborhood and their home," the lawsuit stated.

The lawsuit claimed the appraiser used a sales comparison approach to access the home. That’s when an appraiser uses recent sales of a similar home in the area to justify the value of the accessed home.

The lawsuit stated the appraiser, “blatantly violated professional appraisal standards by improperly limiting the geographic areas from which he considered properties to compare.” The lawsuit added, the “...decision to geographically limit the area from which he selected comparable sales reflected his belief that, because of their race, Dr. Connolly and Dr. Mott did not belong in Homeland, an attractive and predominately white neighborhood.”

The lower-than-expected appraisal caused their application to refinance with loanDepot to be denied.

“I get angry,” said Mott. “[loanDepot] didn’t back us up. They doubled down on the undervaluation of our home.”

The news also came during a part of their family vacation where Dr. Mott learned she was diagnosed with cancer.

Months went by and the couple decided to go through the application progress again. This time with another lender and a different appraisal company. And before the house was appraised, the couple removed any signs a Black family occupied the house.

“You start to get to the point where you’re looking for small fragments; a toy here, a Christmas card there. And then you have to start thinking about curating the house,” said Connolly.

Instead of prominently displaying the artwork of their children or important markers from Black history, they hoisted a large painting of ‘White Jesus’ on the wall.

“We call him 'Appraising Jesus',” said Connolly as he held the painting.

Dr. Connolly took his experiment a step further by asking one of his white colleagues to stand in during the appraisal. The lawsuit stated the second appraisal returned at $750,000 nearly $300,000 more than the first appraisal from 20/20 Valuations.

“Why did we have to go through all of this,” Mott questioned.

Dr. Connolly wondered, “Why did we have to strip ourselves of our house to get someone to see it?”

WUSA9 went to the location listed for 20/20 Valuations. No one answered the door and phone calls have gone unanswered. And while loanDepot did not address the lawsuit directly, the company said in a statement, “We strongly oppose bias in the home fiancé process.” They added, “While appraisals are performed independently by outside expert appraisal firms, all participants in the home finance process must work to find ways to contribute to eradicating bias.”

The couple is seeking both compensatory and punitive damages.

“There’s gotta be a message sent to the mortgage industry,” said Connolly.

In 2018, research conducted by Dr. Andre Perry, Senior Fellow at the Brookings Institute, found that the misvaluation of houses owned by Black and Brown is not only widespread but also resulted in an average loss of $48,000 in value.

“This is the money families use to uplift themselves,” said Perry in an interview with WUSA 9 last week. “This is robbing families of vital resources.”

In November of 2021, WUSA 9 published extensive reports of Black families in Prince George’s County who had similar experiences with lower-than-expected home appraisals. None of them sued or filed formal complaints. But they did form the Fair & Unbiased Appraisal Advocates; an advocacy group of homeowners and stakeholders committed to addressing alleged home appraisal bias throughout the region.

“While Connolly and Mott knew how to effectively advocate for themselves to get a more accurate appraisal, many homeowners don’t or simply can’t. You can’t whitewash an entire neighborhood or county that’s predominately Black,” said Jackie Priestly, Co-Founder of FUAA. We also know federal and state fair housing and fair lending reform are long overdue.”

In March, families involved in WUSA9’s home appraisal bias investigation were invited to the White House as the Biden Administration announced an action plan from its Interagency Task Force on Property Appraisal and Valuation Equity. Some of those items included diversity training for appraisers and diversification of the appraisal workforce, which is overwhelming made up of White Males, data shows from the PAVE task force showed.

“I want to see policy. We need data transparency and regulations,” said Perry.