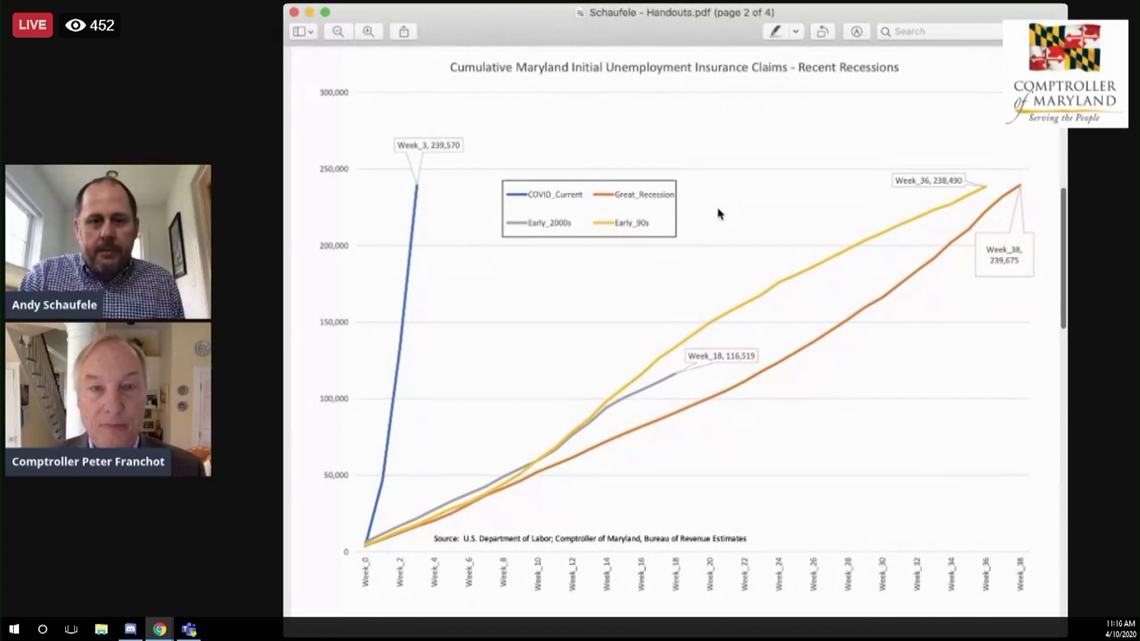

ANNAPOLIS, Md. — One of Maryland's chief budget officers says he's never seen unemployment claims this high.

"I have never seen a line like this in a chart and we all know, I spend the majority of my time looking at charts," Maryland's director of revenue estimates, Andrew Schaufele, said.

Schaufele is referencing a blue line, representing unemployment claims, that is skyrocketing due to COVID-19. Compared to that are unemployment waves from past recessions, which pale in comparison in speed and impact.

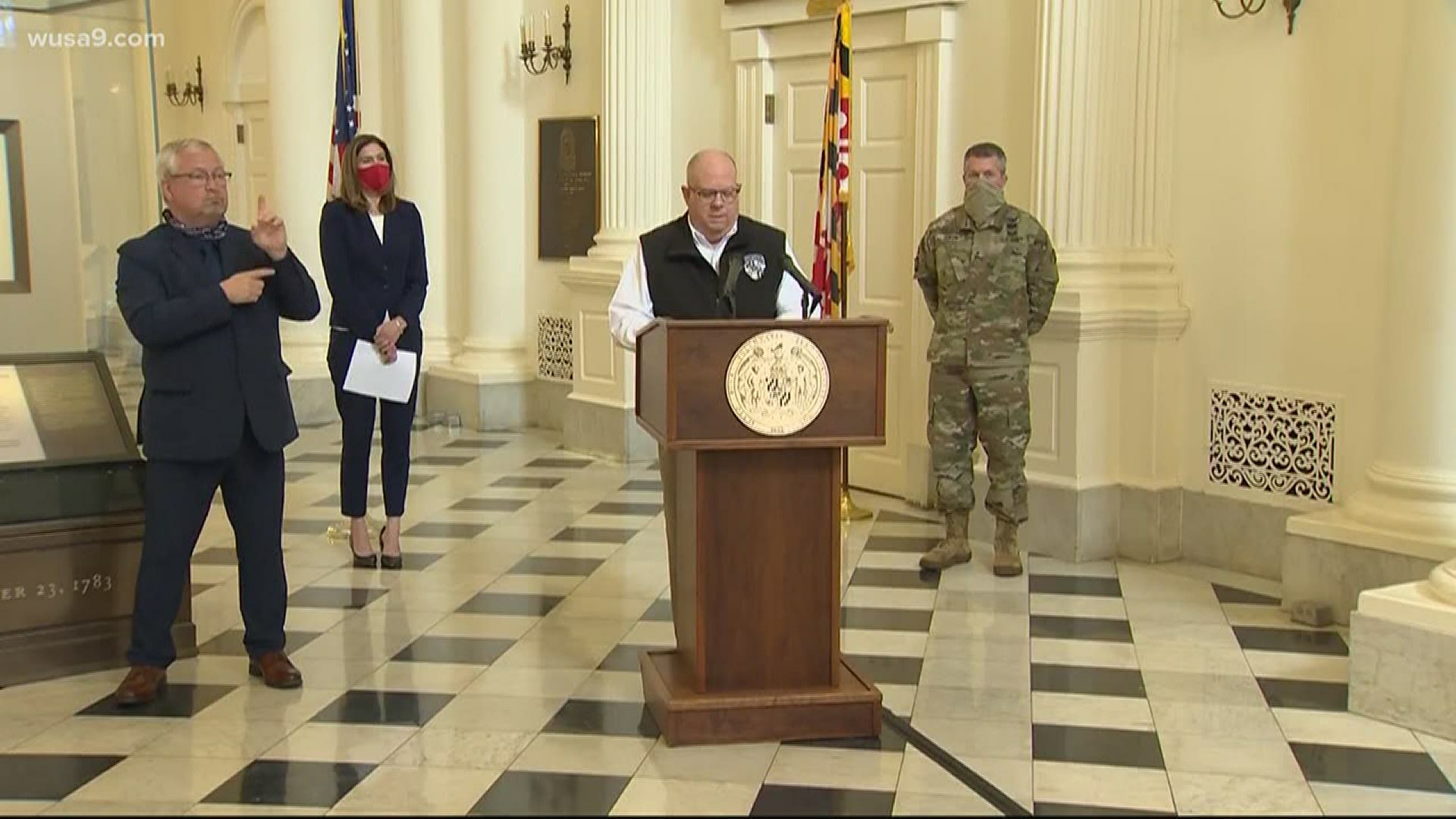

Maryland Governor Larry Hogan addressed the grim cost of coronavirus at the statehouse in Annapolis Friday afternoon.

"The Maryland Department of Budget and Management will be determining options and making recommendations for budget cuts, which will be required in all state agencies," Hogan said. "This will include cuts to so-called 'mandated spending.'"

People simply can’t afford to pay as much Maryland sales tax compare to before the pandemic, or they don’t have jobs anymore to pay income taxes. Maryland projects a shortfall of $2.8 billion over the next 90 days -- half what it usually pulls in to pay for vital state programs.

"In addition, the state will be tapping into and spending much of, perhaps even all of, the state’s rainy day fund balance," Hogan said.

Maryland’s savings account of $1.2 billion may not last long at this rate, according to the governor. Another thing likely to disappear is the more than 679 bills the Maryland General Assembly spent months efforting before the pandemic.

"It is very unlikely that any bills that require increased spending will be signed into law," Hogan said.

Maryland Comptroller Peter Franchot laid out the state’s financial future in urgent tones.

"I don’t want to sugarcoat this," he said. "In the coming months and over the foreseeable future, the governor, Board of Public Works and the General Assembly will have to make very, very difficult decisions to ensure our state’s short term and long term fiscal stability."

Maryland also has a statewide hiring and spending freeze effective Friday. The only exceptions are COVID-19 related expenses and employee payroll.