WASHINGTON — Mortgage rates have shot up this year, and just yesterday, the Federal Reserve hiked interest rates again. That could potentially push mortgage rates even higher, so we’re verifying how increased rates have already impacted our local housing market.

THE QUESTION:

Are fewer people buying houses in the DMV, and are interest rates to blame?

OUR SOURCES:

THE ANSWER:

Yes, there are fewer home sales in the DMV, and rising interest rates are part of the problem.

WHAT WE FOUND:

On average, fewer homes are being sold across the D.C. Metro Area. Data from Bright MLS indicates that sales were down by 28% in September 2022 compared to 2021.

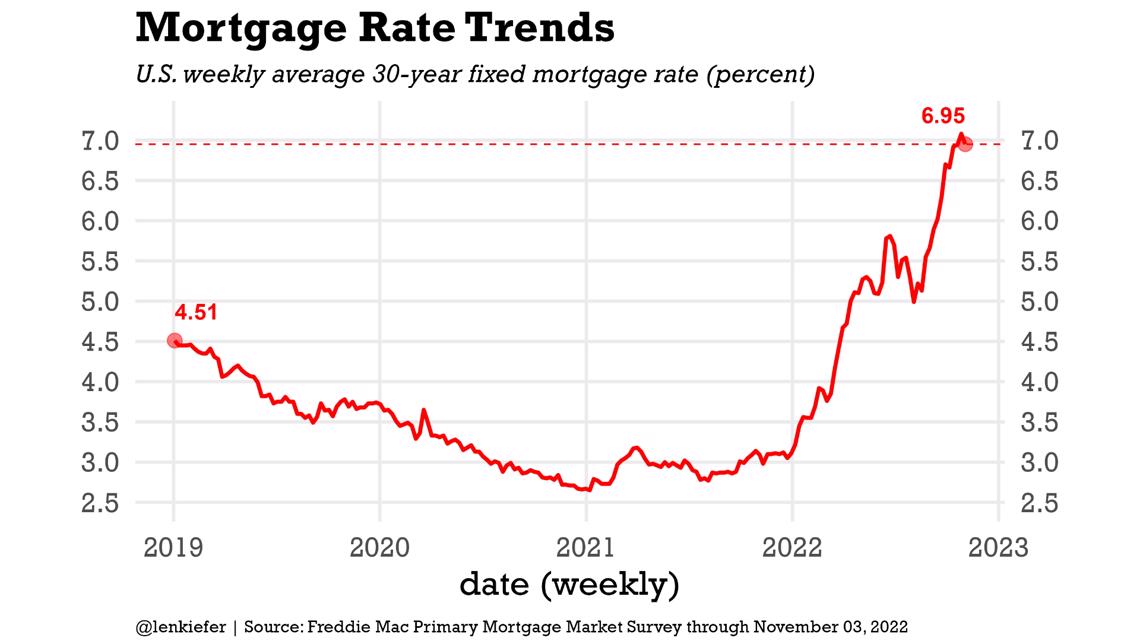

According to Van Order, the decline has a lot to do with interest rates. Thanks in large part to the Fed’s rate hikes, mortgage rates have more than doubled this year, which changes the behaviors of both buyers and sellers.

“It makes the cost higher for new buyers, people coming into the market.” says Van Order, “But it also makes it considerably more difficult for existing homeowners”

On the buyer side, higher mortgage rates are pricing people out of the ability to buy a home. But a lot of the decline has to do with sellers too. Think of it this way: if someone owns a house and has a 3% mortgage locked in, selling their home and taking on a new monthly payment at 7% isn’t appealing.

Because of that, Rice says, the number of houses on the market has shrunk in many areas.

For example - “Inventory is down, Montgomery and PG County, 20%.” said Rice, “I mean, it’s amazing. Last year, there were… 5000 houses launched in fall of 2021, and 4039 were launched in 2022. So there’s 1000 less properties in just Montgomery County and PG County.”

What about Virginia? Rice pulled the numbers for Fairfax, Alexandria, and Arlington:

“Last year 4,401 properties were launched in that fall market. 3,334 were launched in this fall market. So that's down 25%.”

Given the drop in available homes, it makes sense that purchases are down. So what are we supposed to do?

According to Rice, you don’t need to be afraid, whether you’re buying or selling. “Here's the deal,” she said,” everybody has to start doing a little bit more work, a little more homework. Talk to your lending partner.”

We at VERIFY aren’t telling you to buy a house, but Rice says that if buying a home is your goal, then you have options on how best to make it happen.