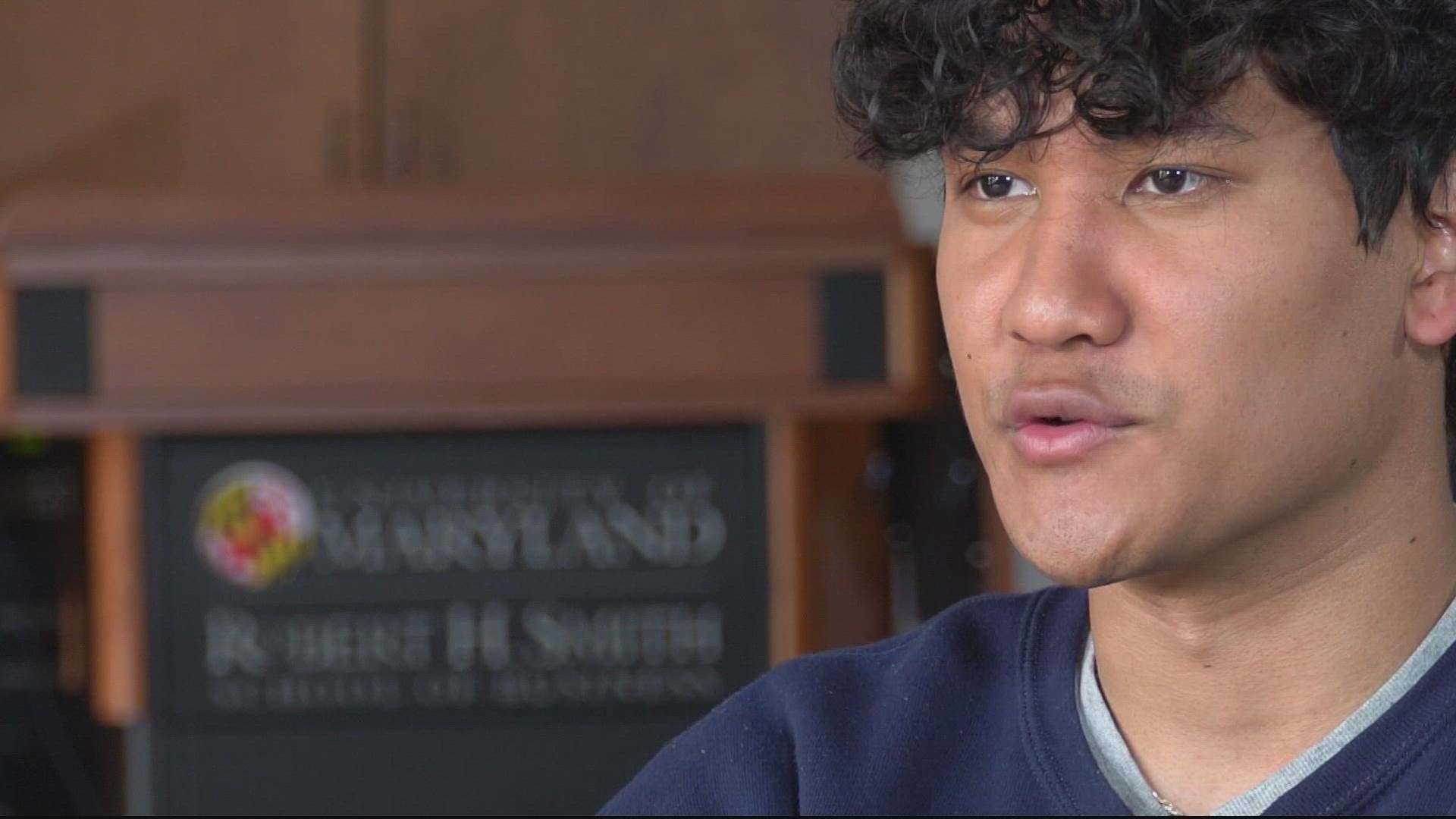

WASHINGTON — In the spring of 2021, University of Maryland senior Ronit Tuladhar noticed two things happening online. All types of cryptocurrencies saw a massive boost in investment. He also saw online-gaming influencers talking about cryptocurrency.

“A lot of these kind of gaming YouTubers, I had watched a lot of them and seeing that they were promoting cryptocurrency,” Ronit said.

It’s a 21st-century phenomenon. Lives and monies that exist completely online. People like Ronit have grown up following online influencers since they were kids. But, this was the first time he saw them promoting cryptocurrencies.

“Seeing that kind of sparked my initial interest,” he said.

Ronit found it wasn’t just gamers. All different social media influencers in 2021 were somehow involved in talking about cryptocurrencies on their platforms.

“I was wondering, ‘Why are (they) trying to drive traffic to these coins?” he asked.

If you haven’t gotten a fully comprehensive understanding of cryptocurrency, it’s OK. The concept itself is abstract and still unfolding. At its core, cryptocurrencies are digital codes that exist online. They have names like, "Bitcoin," "Ethereum," and "DogeCoin."

Proponents of cryptocurrency see it as an unregulated and decentralized currency online that will one day replace money. But, in the window between now and that potential future lives a world of speculation.

At this point, people buy cryptocurrencies or coins, on the promise of a bright future. The more people buy them, the more they’re worth. Bitcoin, for example, is worth thousands.

But, those weren’t the coins that Ronit saw influencers pushing.

“I saw that a lot of them dropped, and I saw a lot of them just kind of just plummeted to zero,” he said.

One gaming YouTube influencer he focused on had millions of followers across several platforms. In June of 2021, this influencer promoted a coin called “Milf Token” for a few weeks.

Ronit saw that after it was promoted on the influencer’s platforms the number of people buying it rose. At its peak, $20 million a day was invested into it. But then, not long after the peak, the influencer stopped promoting the coin.

“It just completely plummets over the course of the entire month,” Ronit explained.

As of this report, online exchanges show that "Milf Token" today only has about $30 traded on it daily.

In the meantime, the influencer has removed all his posts about "Milf Token."

The people who bought the coin, they are out of luck.

“There needs to be some sort of like legal consequence for what these influencers are doing,” Ronit said.

We aren’t naming the influencer because he isn’t facing any charges.

However, earlier this year, one of the most famous social media influencers did: Kim Kardashian.

The Securities and Exchange Commission fined her millions of dollars for not disclosing she was paid to promote a coin called EthereumMax. It was one of the first landmark fines by a regulatory agency against someone for promoting a coin.

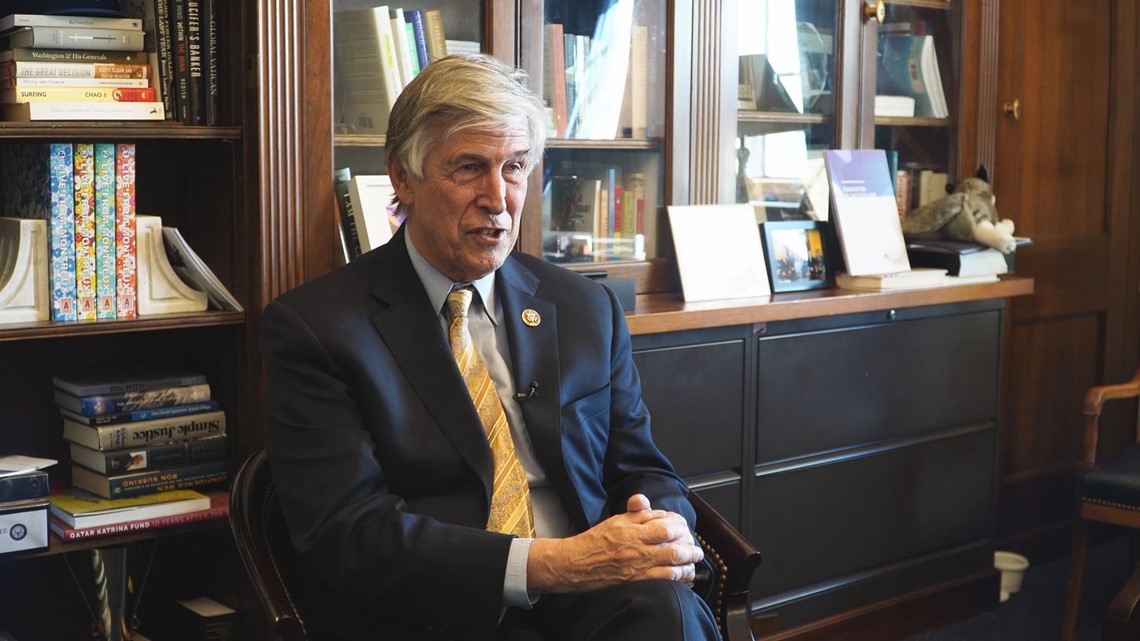

“They’ve just been the Wild West,” said Virginia Rep. Don Beyer. “It's a phenomenon that cries out for meaningful guardrails.”

But before you put up guardrails, you must see who puts them up. Right now, two agencies oversee different aspects of cryptocurrency: The Commodities Futures Trading Commission (CFTC) and the Securities and Exchange Commission.

There aren’t clear guidelines as to which cases fall under which agency’s purview. For example, the CFTC handles Bitcoin-related issues. The SEC handled EthereumMax. But no one has claimed "Milf Token."

Part of Beyer’s bill would define oversight responsibility.

“Once we get the regulatory authority, they can be much more aggressive about protecting the investors,” Beyer said.

While the government sorts things out, Ronit turned his findings into a school project. During the winter of 2021-22, he mapped out several token schemes that saw influencers promoting coins that rose. Then erasing their posts when the coins tanked.

“This can’t just keep happening,” he said. “People can’t keep losing their money.”

But he now has on paper a 21-century cautionary tale when social media and digital investing collide.

“I can see the reach that these people have and like how many people they are actually touching by promoting these coins and just how dangerous it is,” he sighed.

>Read Ronit Tuladhar's report below:

With cryptocurrency prices plummeting, we spoke with a trio of financial experts about why the prices are dropping, and what this tells us about crypto's future.