MARYLAND, USA — After WUSA 9 published a report last November detailing allegations of home appraisal bias in Prince George’s County, more families have come forward with similar experiences. These families claim because they’re Black homeowners in majority-Black neighborhoods, some home appraisers are assigning lower values, suggesting these neighborhoods do not hold equal value to houses in majority-white neighborhoods.

Nichelle Shaw believes she may have been a victim of appraisal bias. The Hyattsville homeowner purchased her house in 1999 for $109,000. She refinanced her house several times and said she never had a problem. But her luck ran out in 2019.

“I knew in my gut it was wrong,” said Shaw, describing her own experience with a lower-than-expected appraisal.

In 2019, Shaw was once again going through the process to get her house refinanced. The first appraisal returned at $273,000.

“When I got the report back, it was saying stuff like I need to paint the house, I needed to fix the taps," she said. "I would have to spend about $5,000 to refinance a house I'm staying in."

The report didn’t make sense to her, especially since similar houses in her neighborhood were selling for $300,000.

“I felt a little foolish,” Shaw said.

She closed her case with the bank she was working with and went to another bank. When the house was appraised again, it was valued at $315,000—an increase of $40,000.

Examples like Shaw’s highlight the need for change in the home appraisal process.

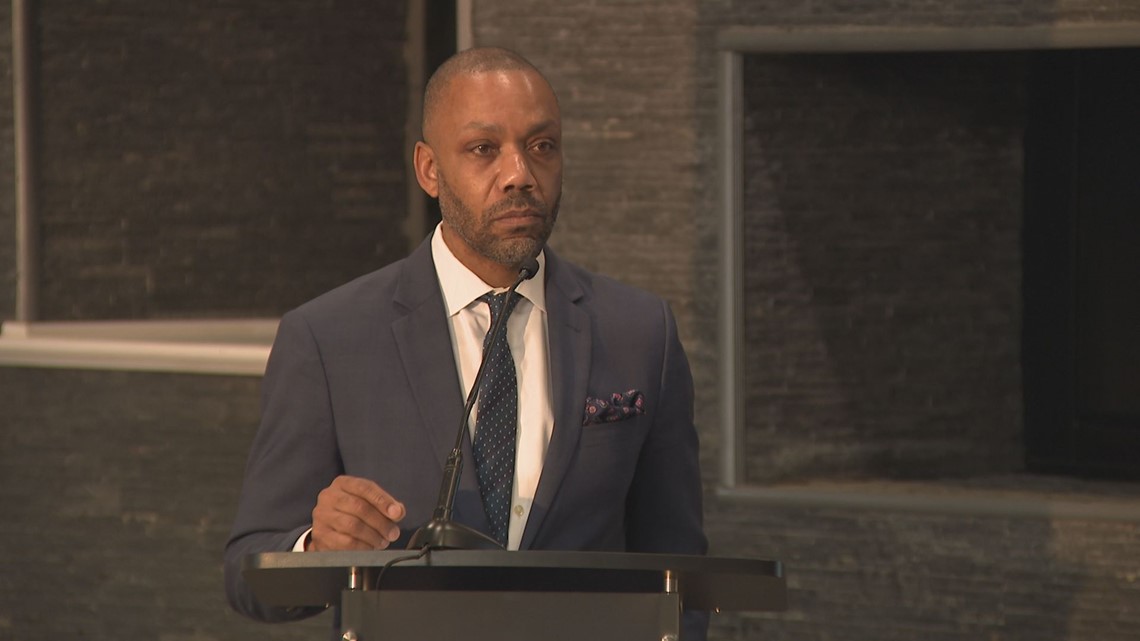

"If we can find ways to remove these drags or racism from housing markets, you uplift entire economies, you [can] uplift [an] entire family," said Dr. Andre Perry, Senior Fellow at the Brookings Institute. "So, it's an important issue."

In March, The Interagency Task Force on Property Appraisal and Valuation Equity (PAVE), released its report outlining action items to address inequity within the home appraisal process. Some of the recommendations include enhancing enforcement of fair housing laws, requiring appraisers to participate in bias training, and limiting barriers for entry for those wanting to become an appraiser.

“It's one thing to know it and read it. It's another thing to see people who have lived it,” said Secretary of Housing and Urban Development Secretary Marcia Fudge. “The cost of housing today is so phenomenally out of reach for the average person, you can't even buy a home, but we have people who have invested in their homes and are getting nothing."

Many are banking on innovation to help propel change. The Brookings Institute partnered with Ashoka, a social entrepreneurship organization, to create the "Valuing Homes in Black Communities Challenge." The competition gave 10 organizations up to $100,000 to address devaluation. Rosalind Williams, the co-founder of With Action, was one of the winning organizations.

WITH Action uses restorative home appraisals, requiring appraisers to use comparable sales from wealthy white neighborhoods when appraising homes in Black neighborhoods.

“I think a lot lies in the guidelines for appraisers that really just recreates redlining in Black neighborhoods,” said Williams. "I picked restorative because it’s what it should have been if it wasn't for the devaluation of all these years."

John Liss, CEO of True Footage, made it to the semi-finals of the challenge. His company also focuses on home appraisals using a diverse group of certified appraisers and broad data to limit home appraisal bias.

“We're looking at adding more data to the process and making sure that all decisions being made in the appraisal process are focused on data,” explained Liss.

The idea is that with a greater reliance on data, appraisal bias should be limited with fewer incidents. Critics, however, add that if the data is skewed, it could perpetuate the problem as well.

Sign up for the Get Up DC newsletter: Your forecast. Your commute. Your news.

Sign up for the Capitol Breach email newsletter, delivering the latest breaking news and a roundup of the investigation into the Capitol Riots on January 6, 2021.